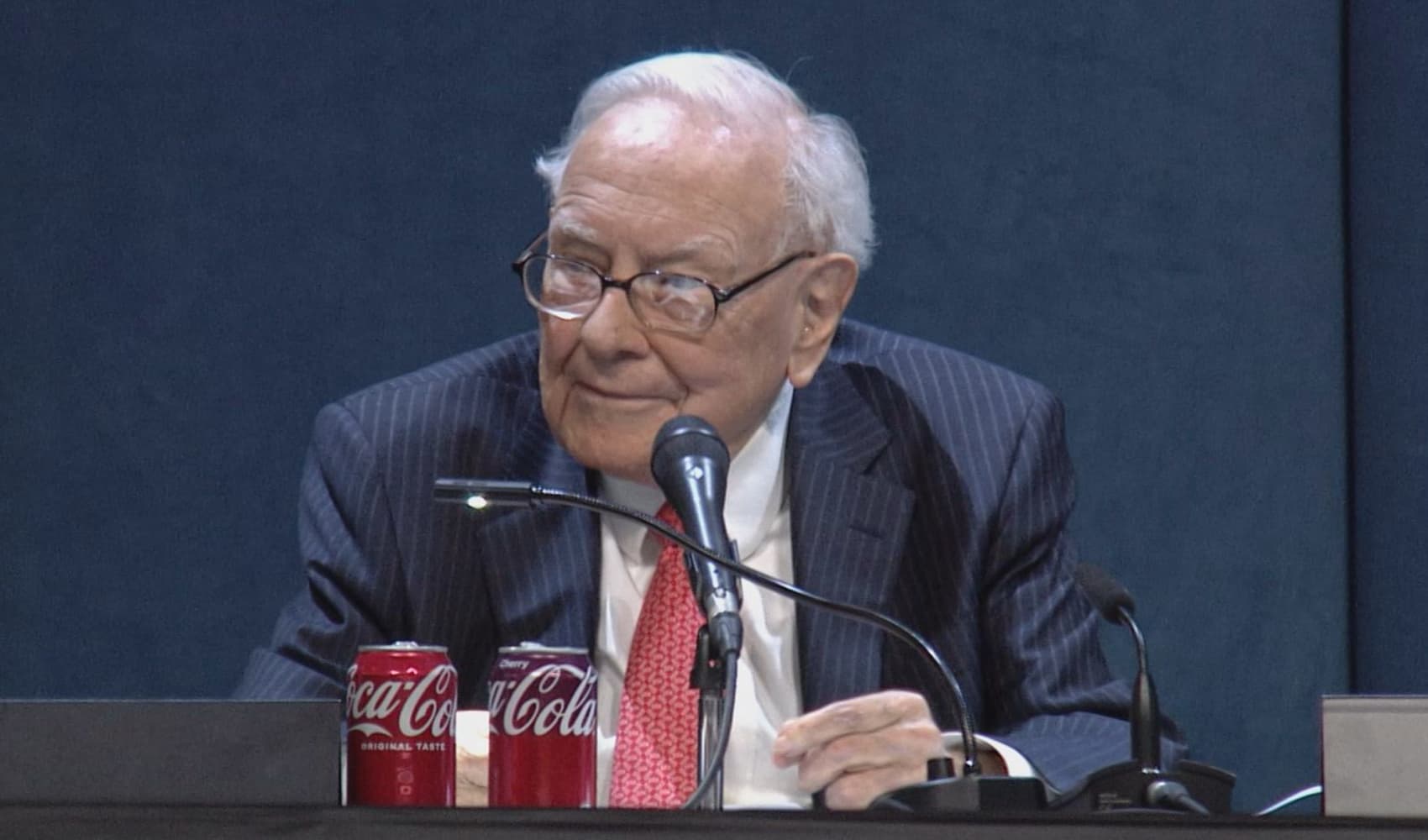

Warren Buffett: Market Volatility? "Really Nothing" to Worry About

Introduction: Buffett's Calm Amidst the Market Storm

The stock market can feel like a rollercoaster, right? One minute you're soaring, the next you're plummeting. It's enough to make even seasoned investors feel queasy. But imagine having the wisdom and experience to look at those wild swings and simply shrug. That's precisely what Warren Buffett, the legendary investor and CEO of Berkshire Hathaway, did recently. He dismissed the recent market volatility that has sent shivers down the spines of many as "really nothing." What's behind this seemingly nonchalant attitude? Let's dive in and explore what Buffett's perspective means for us.

Buffett's Perspective: Decades of Experience Talking

At Berkshire Hathaway's annual meeting, Buffett addressed the recent market jitters, offering a reassuring perspective rooted in decades of investing experience. He emphasized that these fluctuations are a normal part of the investment landscape and shouldn't be a cause for panic. For Buffett, this isn't his first rodeo; he's seen these cycles play out time and time again.

Historical Context: Berkshire's Resilience

Buffett's confidence isn't just based on a gut feeling. He pointed out that even Berkshire Hathaway, a company known for its stability and long-term growth, has experienced significant drops in its stock price throughout its history. Three times in the past six decades, Berkshire's stock has declined by a whopping 50%. Imagine that!

Berkshire's 50% Drops: A Learning Opportunity

He emphasized that during those periods, there wasn't a fundamental issue with the company itself. The declines were often due to broader market conditions or investor sentiment, not necessarily a reflection of Berkshire's underlying value. This is a crucial distinction.

Fear vs. Opportunity: Buffett's Contrarian Approach

Buffett's famous quote, "Be fearful when others are greedy, and greedy when others are fearful," perfectly encapsulates his contrarian investment philosophy. He isn't swayed by the emotions of the crowd. In fact, he often sees market downturns as opportunities to buy quality companies at discounted prices.

"Fantastic Opportunity": A Bold Statement

He even went so far as to say that if Berkshire's stock were to plummet 50% next week, he would view it as a "fantastic opportunity." That's a pretty bold statement, isn't it? But it highlights his unwavering belief in the long-term value of his company and his ability to identify undervalued assets.

Long-Term Investing: The Foundation of Buffett's Success

Buffett's philosophy is rooted in long-term investing. He doesn't chase quick profits or try to time the market. Instead, he focuses on buying and holding high-quality companies with strong fundamentals, regardless of short-term market fluctuations. Think of it like planting a tree: you don't expect it to grow overnight, but with patience and care, it will eventually bear fruit.

Understanding Market Volatility: It's Inevitable

Market volatility is simply a part of investing. It's influenced by a variety of factors, including economic news, political events, and investor sentiment. Understanding this is key to staying calm during market downturns. Expecting smooth sailing all the time is unrealistic; turbulence is part of the journey.

Causes of Market Volatility

- Economic data releases (e.g., inflation, unemployment)

- Geopolitical events (e.g., wars, political instability)

- Interest rate changes by central banks

- Company earnings reports

- Changes in investor sentiment

Emotional Investing: The Pitfalls to Avoid

One of the biggest mistakes investors make is letting their emotions dictate their decisions. Fear and greed can lead to impulsive buying and selling, often at the worst possible times. Buffett's approach is to remain rational and disciplined, focusing on the fundamentals rather than getting caught up in the emotional whirlwind.

Staying Calm in a Crisis: Tips from the Oracle of Omaha

So, how can you stay calm and rational when the market is going haywire? Here are a few tips inspired by Buffett's wisdom:

Tips for Calm Investing

- Focus on the long term: Don't get distracted by short-term fluctuations. Remember your long-term investment goals.

- Do your research: Invest in companies you understand and believe in.

- Diversify your portfolio: Don't put all your eggs in one basket.

- Don't panic sell: Resist the urge to sell during market downturns.

- Seek professional advice: If you're unsure, consult with a qualified financial advisor.

Buffett's Lessons: Applicable to Everyone

You don't need to be a billionaire investor to learn from Warren Buffett's wisdom. His principles of long-term investing, rational decision-making, and emotional discipline are applicable to anyone, regardless of their investment experience or portfolio size. His message is that investing is a marathon, not a sprint. By adopting a patient and disciplined approach, you can increase your chances of achieving your financial goals.

Beyond the Soundbites: Deeper into Buffett's Strategy

While soundbites can be helpful, understanding the depth of Buffett's investment strategy is essential. It's not just about buying cheap stocks; it's about identifying companies with enduring competitive advantages, strong management teams, and the potential for long-term growth. He's looking for businesses that he can understand and hold for decades.

Volatility as a Friend: Embracing the Ups and Downs

Instead of fearing volatility, Buffett sees it as an opportunity. It allows him to buy great companies at lower prices, increasing his potential returns over the long term. It's like a sale at your favorite store: you're not upset that the prices are lower; you're excited about the opportunity to get a good deal.

The Power of Patience: A Virtue in Investing

Patience is perhaps one of the most important virtues in investing. Buffett is known for his ability to sit tight and wait for the right opportunities, even if it means missing out on short-term gains. He understands that time is his ally and that long-term compounding is a powerful force.

Future Outlook: What's Next for the Market?

While no one can predict the future with certainty, Buffett's perspective offers a valuable framework for navigating the uncertainties of the market. By staying focused on the long term, remaining rational, and embracing volatility, you can position yourself for success, regardless of what the market throws your way. Remember, it's about time *in* the market, not timing the market.

Conclusion: Buffett's Timeless Wisdom

Warren Buffett's recent comments about market volatility offer a valuable lesson for all investors. He reminds us that market fluctuations are a normal part of investing and shouldn't be a cause for panic. By focusing on the long term, remaining rational, and embracing volatility as an opportunity, we can weather the storms and achieve our financial goals. His wisdom isn't just about investing; it's about having a disciplined and patient approach to life. So, the next time the market takes a dip, remember Buffett's words: it's "really nothing" to worry about, as long as you're prepared.

Frequently Asked Questions (FAQs)

Here are some frequently asked questions about market volatility and Warren Buffett's approach to investing:

- What exactly is market volatility?

- Market volatility refers to the degree of price fluctuation in a market, security, or index over a period of time. High volatility means prices are swinging wildly, while low volatility means prices are relatively stable.

- Why does market volatility happen?

- Market volatility can be triggered by a variety of factors, including economic news, political events, changes in investor sentiment, and company-specific announcements. Essentially, any event that creates uncertainty or fear in the market can lead to increased volatility.

- Should I sell my investments during a market downturn?

- Generally, selling investments during a market downturn is not recommended, as it can lock in losses. Instead, consider staying the course and focusing on the long term. Market downturns can present opportunities to buy undervalued assets.

- How can I reduce my anxiety during periods of market volatility?

- To reduce anxiety during volatile periods, focus on your long-term investment goals, diversify your portfolio, and avoid checking your portfolio too frequently. Educate yourself about investing and seek advice from a qualified financial advisor if needed.

- What is Warren Buffett's key investment strategy?

- Warren Buffett's key investment strategy involves buying and holding high-quality companies with strong fundamentals for the long term. He focuses on companies with enduring competitive advantages, strong management teams, and the potential for long-term growth. He also emphasizes the importance of patience and emotional discipline.