Warren Buffett's Shock Exit: Berkshire Shareholders Reel!

An Unexpected Announcement Shakes Omaha

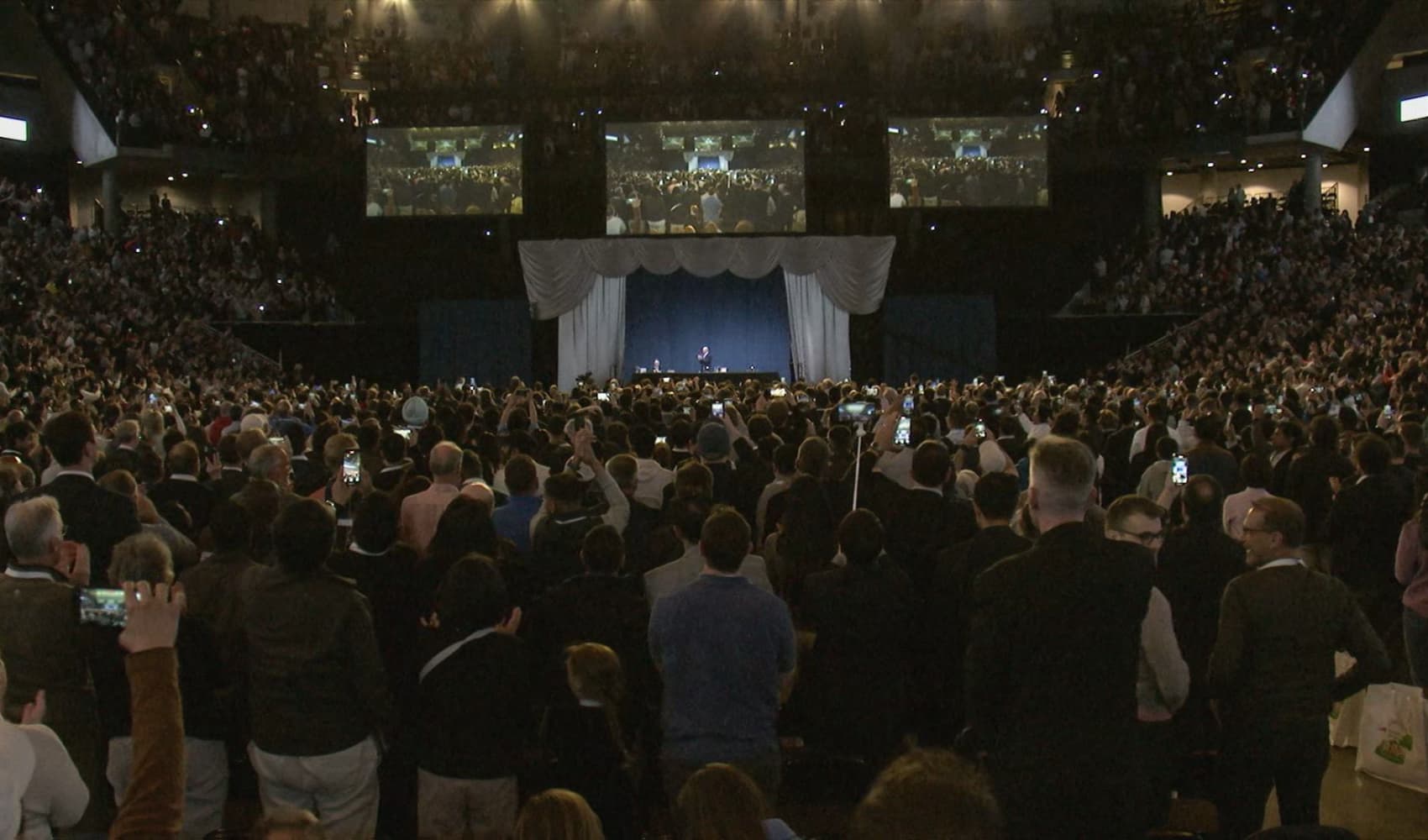

OMAHA, Neb. — The atmosphere around Berkshire Hathaway's annual meeting is usually one of celebration and eager anticipation. Shareholders flock to Omaha from every corner of the globe, not just for a glimpse of the "Oracle of Omaha," but to bask in the wisdom of a man who transformed a struggling textile company into a financial behemoth. But this year, the jovial mood took an unexpected turn. As the weekend unfolded, the news dropped like a bombshell: Warren Buffett, the iconic CEO, announced his intention to step down by the end of the year.

Imagine the scene: thousands of investors, many of whom have followed Buffett's teachings for decades, absorbing this revelation. The man who has guided them through booms and busts, who has become synonymous with value investing, is preparing to hand over the reins. It's a moment that has left many "stunned," as one shareholder aptly put it.

The News Breaks: A Collective Gasp?

The announcement wasn't delivered with fanfare or a prepared speech. Instead, it came during the customary marathon question-and-answer session that Buffett so famously conducts. He casually mentioned that he would request to leave the chief executive post at Berkshire's upcoming board meeting. Did anyone see this coming? Probably not. The timing and the seemingly offhand way it was delivered added to the surprise. Even those closest to him were reportedly caught off guard, adding to the sense that this was a decision made with careful consideration, but perhaps not widely anticipated.

The Reaction: From Shock to Speculation

Local Perspective: A Neighbor's Surprise

Jim Ross, a bookstore manager and Buffett's neighbor, perhaps summed up the general feeling best: "I'm stunned." Living just a few doors down from the "Oracle of Omaha," Ross likely shares a sense of community with Buffett, a connection that amplifies the shock of this news. It's a reminder that even legends are human, and that change, however unexpected, is inevitable.

Global Investors Weigh In

Beyond Omaha, the news reverberated through the global investment community. Experts and analysts are scrambling to assess the potential impact on Berkshire Hathaway's stock price, its investment strategy, and its overall future. Will the company maintain its value-driven approach? Will the new leadership be able to fill Buffett's shoes? These are the questions dominating discussions across trading floors and online forums.

The Buffett Legacy: More Than Just Money

Let's be honest, Warren Buffett is more than just a CEO. He's a cultural icon, a symbol of integrity, and a role model for aspiring investors. His folksy charm, his down-to-earth personality, and his unwavering commitment to ethical business practices have made him a beloved figure, not just in the financial world, but far beyond.

Value Investing: A Philosophy Embodied

Buffett's success is inextricably linked to his unwavering adherence to value investing principles. He doesn't chase trends or get caught up in market hype. Instead, he focuses on identifying fundamentally sound companies with strong management teams and sustainable competitive advantages. He buys them when they're undervalued and holds them for the long term. It's a simple strategy, but one that has proven remarkably effective over the decades. Will this strategy continue?

Philanthropy and Giving Back

Beyond his investment prowess, Buffett is also renowned for his philanthropic endeavors. His commitment to giving away the vast majority of his wealth to charitable causes has set an example for other billionaires and has inspired countless individuals to make a difference in the world. His partnership with Bill and Melinda Gates has been particularly impactful, supporting initiatives aimed at tackling some of the world's most pressing challenges.

The Succession Plan: Who Will Take the Reins?

The burning question on everyone's minds is: who will succeed Warren Buffett? While he hasn't officially named his successor, Greg Abel, Berkshire Hathaway's vice chairman of non-insurance operations, is widely considered to be the frontrunner. Abel has a proven track record of success within the company and is highly regarded by Buffett and other key executives. But can anyone truly replace Buffett? That remains to be seen.

Greg Abel: The Heir Apparent?

Abel's operational expertise and his deep understanding of Berkshire Hathaway's diverse portfolio of businesses make him a logical choice. He has demonstrated his ability to drive growth and profitability across various industries, from energy to manufacturing. However, stepping into Buffett's shoes is a daunting task, one that requires not only business acumen but also the ability to inspire and lead a vast and complex organization.

Other Potential Contenders

While Abel is the leading candidate, other names have also been mentioned as potential successors. Ajit Jain, Berkshire Hathaway's vice chairman of insurance operations, is another highly respected executive with a long history at the company. He is known for his expertise in the insurance industry and his ability to generate substantial profits. Ultimately, the decision rests with Berkshire Hathaway's board of directors, who will carefully consider the qualifications and experience of all potential candidates.

Berkshire Hathaway: The Future Beyond Buffett

Even with Buffett stepping down, Berkshire Hathaway is expected to remain a powerhouse in the financial world. The company's diverse portfolio of businesses, its strong balance sheet, and its deep bench of talented managers position it for continued success. However, the transition to a new leader will undoubtedly present challenges.

Maintaining the Corporate Culture

One of the biggest challenges will be preserving Berkshire Hathaway's unique corporate culture, which is characterized by its decentralized management structure, its focus on long-term value creation, and its emphasis on ethical behavior. Buffett has instilled these values throughout the organization, and it will be crucial for his successor to maintain them.

Adapting to a Changing World

The business landscape is constantly evolving, and Berkshire Hathaway will need to adapt to stay ahead of the curve. This may involve embracing new technologies, exploring new investment opportunities, and adjusting its business model to meet the changing needs of its customers. Can the new leadership successfully guide Berkshire Hathaway through these changes?

The End of an Era: A Time for Reflection

Warren Buffett's decision to step down marks the end of an era. His leadership has shaped Berkshire Hathaway into the global conglomerate it is today. But it's also a time for reflection, a moment to appreciate his contributions to the world of finance and to acknowledge the impact he has had on the lives of countless individuals. He's shown that integrity, patience, and a commitment to value can lead to extraordinary success. And that's a lesson that will resonate for generations to come.

The Lasting Impact on the Stock Market

The announcement's impact on the stock market is difficult to predict with certainty. While some investors may be concerned about the uncertainty surrounding the succession plan, others may see it as an opportunity for Berkshire Hathaway to evolve and adapt. Ultimately, the market's reaction will depend on the confidence that investors have in Buffett's successor and in the company's ability to maintain its value-driven approach.

A Word of Caution for Investors

In times of uncertainty, it's important for investors to remain calm and avoid making rash decisions. Don't let fear or speculation drive your investment strategy. Instead, focus on the fundamentals and stick to your long-term goals. Remember, Warren Buffett's success was built on patience and discipline, qualities that are just as important today as they were decades ago.

Conclusion: The Legacy Continues

Warren Buffett's impending departure signals a significant shift for Berkshire Hathaway and the investment world. While the news has undeniably "stunned" shareholders, it's also a moment to recognize the extraordinary legacy Buffett leaves behind. His value investing principles, ethical leadership, and philanthropic endeavors have made him a role model for generations. While the future holds uncertainty, Berkshire Hathaway's strong foundation and the principles instilled by Buffett offer confidence that the company will continue to thrive. The question now is: can anyone truly fill the shoes of the "Oracle of Omaha"? Only time will tell.

Frequently Asked Questions

Q: When exactly will Warren Buffett step down?

A: Buffett stated his intention to request to leave the CEO post by the end of the year at Berkshire Hathaway's board meeting on Sunday, but a specific date has not been announced.

Q: Who is the likely successor to Warren Buffett?

A: Greg Abel, Berkshire Hathaway's vice chairman of non-insurance operations, is widely considered the frontrunner.

Q: What impact will Buffett's departure have on Berkshire Hathaway's stock?

A: The impact is uncertain, but analysts suggest the market's reaction will depend on confidence in Buffett's successor and the company's ability to maintain its value-driven approach.

Q: Will Berkshire Hathaway's investment strategy change after Buffett leaves?

A: It's possible, but the expectation is that the core principles of value investing will remain central to the company's strategy. The level of decentralization may change, but is not expected to be substantial.

Q: How can investors prepare for this transition at Berkshire Hathaway?

A: Investors should remain calm, focus on the company's fundamentals, and stick to their long-term investment goals. Avoid making impulsive decisions based on speculation.