Cramer's Week Ahead: Tech Earnings & Economic Data Guide

Cramer's Crystal Ball: Will Tech Earnings & Economic Data Shine or Shatter?

Decoding the Week Ahead: Cramer's Take on Tech Earnings and Economic Crossroads

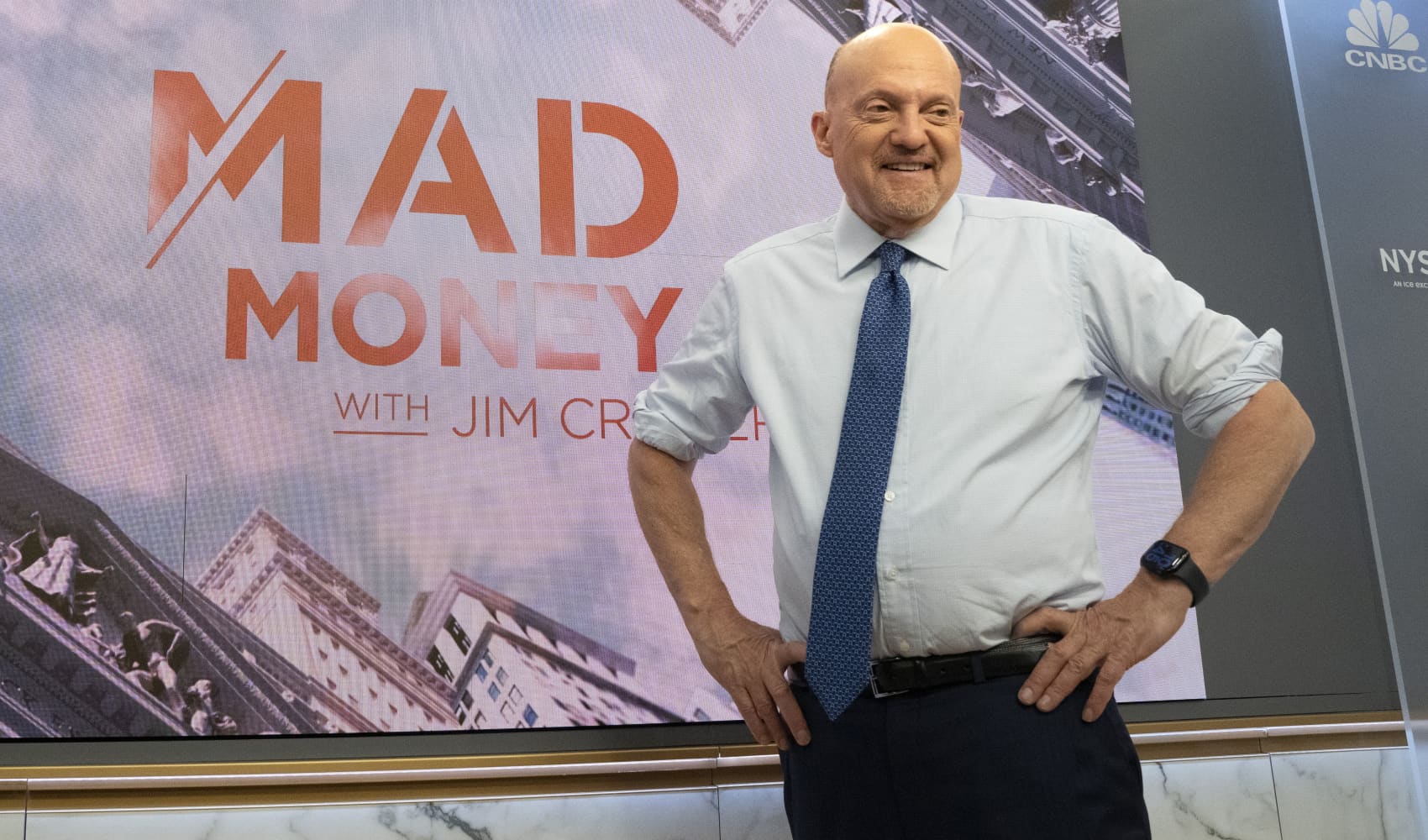

Ready for another rollercoaster week on Wall Street? CNBC’s Jim Cramer has his eyes glued to the ticker tape, and he’s sharing his insights to help you navigate the upcoming market frenzy. This week is packed with earnings reports from tech behemoths like Apple, Amazon, Microsoft, and Meta, plus a deluge of crucial economic data. But that's not all! Cramer emphasizes the ever-present shadow of tariff policy, a wildcard that could significantly impact market performance. So, buckle up, because we're diving deep into Cramer's predictions and what they mean for your portfolio.

Earnings Season in Overdrive: Tech Giants Under the Microscope

Apple's Balancing Act: Innovation vs. Inflation

Apple's earnings are always a big deal, aren't they? Will they continue to defy gravity, or will inflationary pressures finally take a bite out of their margins? Cramer will be closely watching iPhone sales figures and the company's outlook on future growth. Remember, Apple is more than just a phone company; it's an ecosystem. Their services revenue, including Apple TV+ and AppleCare, is becoming increasingly important. Can Apple maintain its premium brand image in a tightening economy?

Amazon's Transformation: Beyond Retail

Amazon, the king of e-commerce, is rapidly diversifying. Their cloud computing arm, Amazon Web Services (AWS), is a massive profit generator. Cramer is keen to see how AWS performs amidst growing competition and whether Amazon's cost-cutting measures are paying off. He'll also be looking for signs of recovery in their retail business. Can Amazon successfully navigate the challenges of rising shipping costs and supply chain disruptions?

Microsoft's AI Ambitions: A Glimpse into the Future

Microsoft is betting big on artificial intelligence. Their partnership with OpenAI, the creator of ChatGPT, is making waves. Cramer will be analyzing how Microsoft is integrating AI into its various products, from Azure cloud services to its Office suite. He'll also be scrutinizing the performance of their gaming division, including Xbox. Is Microsoft poised to dominate the AI revolution, or will other contenders steal their thunder?

Meta's Metaverse Gamble: Will It Pay Off?

Meta, formerly Facebook, is all-in on the metaverse. Mark Zuckerberg's ambitious vision has faced skepticism, and the company has poured billions of dollars into its metaverse projects. Cramer will be assessing whether Meta is making progress in attracting users and generating revenue from its virtual world. He'll also be keeping an eye on the performance of their core advertising business, which has been impacted by privacy concerns and competition from other social media platforms. Is Meta's metaverse dream destined to become a reality, or will it remain a costly experiment?

Decoding the Economic Data: Gauging the Pulse of the Economy

Inflation's Persistent Sting: The CPI Report

The Consumer Price Index (CPI) report is always a market mover. It gives us a snapshot of inflation, measuring the average change in prices consumers pay for goods and services. Cramer will be dissecting the CPI data to determine whether inflation is cooling down or remains stubbornly high. This report will heavily influence the Federal Reserve's interest rate decisions, so expect significant market volatility surrounding its release.

Labor Market Strength: The Jobs Report

The jobs report, also known as the Employment Situation Summary, provides insights into the health of the labor market. Cramer will be scrutinizing the number of jobs added, the unemployment rate, and wage growth. A strong jobs report typically indicates a healthy economy, while a weak report could signal a slowdown. The Fed also monitors the jobs report closely when making monetary policy decisions.

GDP Growth: Are We Headed for a Recession?

Gross Domestic Product (GDP) measures the total value of goods and services produced in a country. Cramer will be analyzing the latest GDP data to assess the overall health of the economy and whether we are at risk of falling into a recession. Negative GDP growth for two consecutive quarters is generally considered a recession. Will the economy continue to expand, or are we headed for a contraction?

The Fed's Next Move: Interest Rate Hikes or Pause?

The Federal Reserve, the central bank of the United States, plays a crucial role in managing the economy. Cramer will be closely following any signals from the Fed regarding future interest rate hikes. The Fed has been aggressively raising rates to combat inflation, but there are concerns that these rate hikes could trigger a recession. Will the Fed continue its aggressive tightening policy, or will it pause to assess the impact on the economy?

The Tariff Tightrope: Trade Deals and Market Stability

Tariff Policy Uncertainty: A Major Headwind

Tariff policy remains a significant uncertainty for businesses and investors. Cramer emphasizes the need for progress on trade deals to provide some stability to the markets. Tariffs can disrupt supply chains, increase costs for businesses, and lead to retaliatory measures from other countries. A resolution to the trade disputes would be a welcome boost for the global economy.

The Impact on Supply Chains: Rebuilding Resilience

The pandemic exposed vulnerabilities in global supply chains. Cramer will be monitoring how companies are adapting to these challenges by diversifying their supply sources and building more resilient supply chains. Tariffs exacerbate these issues, making it even more difficult for businesses to navigate the complex global landscape.

Geopolitical Risks: A Constant Threat

Geopolitical tensions can have a significant impact on the markets. Cramer is always aware of potential geopolitical risks, such as conflicts or political instability, that could disrupt the global economy. These risks can create uncertainty and volatility in the markets, making it even more important for investors to stay informed and diversified.

Navigating Market Volatility: Cramer's Strategies for Investors

Diversification: Spreading the Risk

Diversification is a cornerstone of any sound investment strategy. Cramer always advocates for diversification, spreading your investments across different asset classes, sectors, and geographic regions. This helps to reduce risk and improve long-term returns. Don't put all your eggs in one basket!

Long-Term Investing: Patience is a Virtue

Investing is a marathon, not a sprint. Cramer encourages investors to focus on the long term and avoid making impulsive decisions based on short-term market fluctuations. Time in the market is more important than timing the market. Stay disciplined and stick to your investment plan.

Staying Informed: Knowledge is Power

In the world of investing, knowledge is power. Cramer emphasizes the importance of staying informed about market trends, economic developments, and company news. Do your research and make informed decisions based on your own risk tolerance and financial goals.

Seek Professional Advice: Don't Be Afraid to Ask for Help

If you're feeling overwhelmed or unsure about your investment decisions, don't hesitate to seek professional advice. A qualified financial advisor can provide personalized guidance and help you create a financial plan that meets your specific needs. There's no shame in asking for help!

Conclusion: Charting Your Course Through a Turbulent Week

This week is shaping up to be a pivotal one, with earnings from tech giants and key economic data releases poised to heavily influence market direction. Remember, Cramer's insights provide a valuable framework, but ultimately, your investment decisions should align with your personal financial goals and risk tolerance. Keep a close eye on those tech earnings, inflation numbers, and any developments in tariff policy. This week could make or break your portfolio, so stay informed, stay disciplined, and good luck!

Frequently Asked Questions (FAQs)

Here are some frequently asked questions to help you better understand the topics discussed in this article:

- What is the significance of Apple's earnings report this week?

Apple's earnings offer a glimpse into consumer spending habits and the overall health of the tech industry. Strong results could signal resilience in the face of economic headwinds, while weak results could raise concerns about a potential slowdown.

- How can the CPI report impact my investments?

The CPI report is a key indicator of inflation. Higher-than-expected inflation could prompt the Federal Reserve to raise interest rates, which could negatively impact stock and bond prices. Lower-than-expected inflation could suggest that the Fed may ease its tightening policy, potentially boosting asset values.

- Why is tariff policy so important to the markets?

Tariffs can disrupt global trade, increase costs for businesses, and lead to retaliatory measures. This creates uncertainty and volatility in the markets, making it more difficult for investors to plan for the future.

- What is the metaverse, and why is Meta investing so heavily in it?

The metaverse is a virtual world where users can interact with each other and with digital objects. Meta believes that the metaverse has the potential to be the next major computing platform and is investing heavily in developing the technologies and infrastructure needed to make it a reality.

- What is the best strategy for navigating market volatility?

Diversification, long-term investing, and staying informed are key strategies for navigating market volatility. Diversifying your portfolio across different asset classes, sectors, and geographic regions helps to reduce risk. Focusing on the long term and avoiding impulsive decisions based on short-term market fluctuations can help you stay on track to achieve your financial goals. And staying informed about market trends and economic developments allows you to make more informed investment decisions.