Fed's Stagflation Warning: Will Trump's Tariffs Trigger It?

CNBC Daily Open: Fed Warns of Stagflation Risk From Tariffs – Will Trump Listen?

Introduction: A Tightrope Walk for the Economy

Good morning, market movers! Today's CNBC Daily Open brings us a potent mix of economic warnings, market optimism, and technological disruption. The Federal Reserve is waving a yellow flag about the potential for tariffs to trigger stagflation – a particularly nasty combo of stagnant economic growth and rising inflation. But with former President Trump hinting at "very, very big announcement" and a history of tariff enthusiasm, will these warnings even register? Let's dive in and break down what you need to know to navigate these choppy waters.

The Fed's Tariff Tangle: A Recipe for Stagflation?

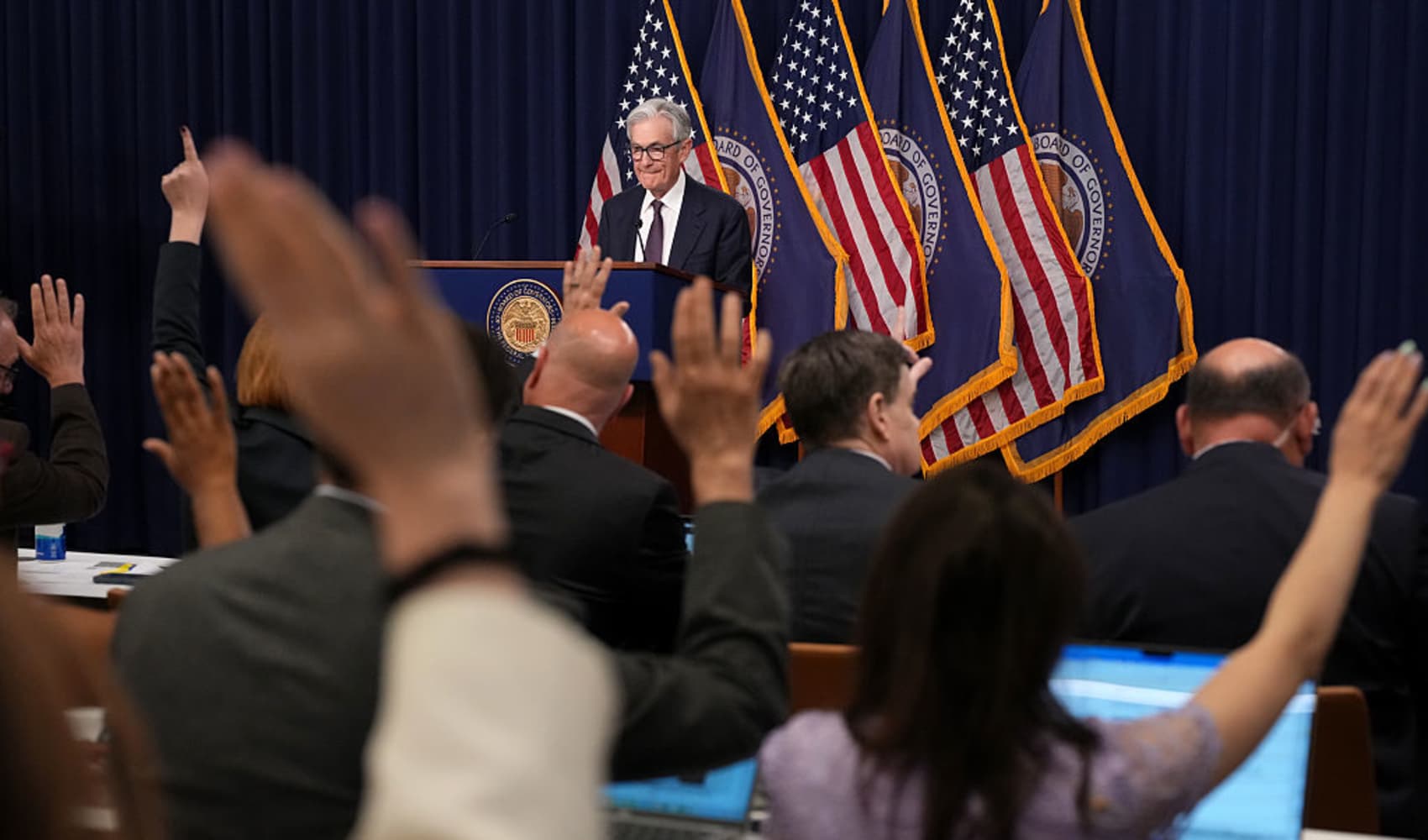

The U.S. Federal Reserve, in its recent meeting, held steady on interest rates and voiced concerns about the negative economic impact of tariffs. They're essentially saying, "Hey, these tariffs could really throw a wrench in the gears."

Why Stagflation is the Nightmare Scenario

Think of stagflation like a car stuck in the mud, spinning its wheels but going nowhere. Rising prices combined with a sluggish economy – it's a recipe for financial pain and policy headaches. The Fed's warning is a serious one, suggesting that the potential benefits of tariffs might be far outweighed by the risks.

Market Momentum: Disney, Nvidia, and a Dose of Optimism

Despite the Fed's cautionary words, the markets showed some serious pep! U.S. indexes rose, fueled by gains in stocks like Disney and Nvidia. It’s like the market is saying, "We hear you, Fed, but we're still feeling optimistic!"

Disney's Magic: Beyond Mickey Mouse

Disney's stock jump suggests investors are betting on the company's streaming strategy and theme park recovery. Are we finally seeing the mouse flex its muscles again?

Nvidia's AI Reign: Riding the Wave of Innovation

Nvidia continues to be a darling of Wall Street, riding the wave of the artificial intelligence boom. The demand for their chips is insatiable, making them a key player in this technological revolution.

Trump's Trade Tactics: Reciprocal Tariffs on the Horizon?

Remember those "reciprocal" tariffs that Trump was talking about? Well, the Fed was already worried about their potential impact back in March, even before they were officially on the table. When the Federal Open Market Committee met in March, U.S. President Donald Trump had yet to unleash his so-called "reciprocal" tariffs on the world.

What are Reciprocal Tariffs Anyway?

Reciprocal tariffs are essentially tit-for-tat trade measures. If one country imposes a tariff on U.S. goods, the U.S. would retaliate with a similar tariff on that country's goods. It's a high-stakes game of trade chicken that can quickly escalate into a full-blown trade war.

AI Chip Wars: Rescinding Biden-Era Restrictions

The geopolitical chessboard is getting even more complex. The Trump administration is reportedly preparing to rescind a Biden-era rule restricting artificial intelligence chip exports.

Why This Matters: Balancing National Security and Economic Growth

This move could have significant implications for the AI race between the U.S. and China. On one hand, it could boost U.S. chipmakers' sales. On the other, it could raise concerns about China's access to advanced technology for military applications. It's a delicate balancing act.

The AI Search Revolution: Apple's Vision

Forget everything you think you know about search engines! Apple's services chief believes AI search engines will replace standard ones such as Google. It’s a bold prediction, but one that could reshape the entire internet landscape.

Goodbye Google, Hello AI Search?

Imagine a search engine that understands your intent, anticipates your needs, and provides personalized results in a conversational manner. That's the promise of AI search, and Apple is clearly betting big on it. Could Google's dominance be coming to an end?

Arm's Mixed Signals: Weak Guidance, Solid Results

Chip designer Arm is sending mixed signals to investors. Arm gives weak guidance for its current quarter, but beat expectations for its fiscal fourth quarter.

Decoding Arm's Guidance: A Sign of Things to Come?

The weak guidance raises questions about the overall health of the semiconductor industry. Is demand slowing down? Are there supply chain bottlenecks? Investors will be watching closely to see if this is a temporary blip or a more significant trend.

The "Very, Very Big Announcement": What's Trump Cooking Up?

Here we go again! Trump loves a good tease, and this time is no different. Trump disclosed that he plans to make a "very, very big announcement." Here's how JPMorgan thinks investors can ride that potential tailwind.

JPMorgan's Strategy: Riding the Trump Wave

JPMorgan is advising investors to prepare for potential market volatility and to identify sectors that could benefit from Trump's policies, whatever they may be. It's a risky game, but one that could pay off handsomely.

The Risk of Policy Error: A Looming Shadow

The biggest risk facing the economy right now is arguably policy error. Whether it's tariffs, interest rate hikes, or regulatory changes, any misstep could have significant consequences.

Navigating the Uncertainty: Stay Informed, Stay Flexible

In this environment of uncertainty, it's crucial to stay informed, diversify your investments, and remain flexible. Be prepared to adjust your strategy as the landscape evolves.

The Global Impact: A World on Edge

The U.S. economy doesn't exist in a vacuum. These policies have ripple effects around the world, impacting trade, investment, and geopolitical stability.

The Interconnectedness of the Global Economy: We're All in This Together

From supply chains to currency fluctuations, the global economy is highly interconnected. What happens in the U.S. affects countries around the world, and vice versa.

The Bottom Line: Proceed with Caution

The market outlook is uncertain. Between the Fed's warnings about stagflation, Trump's potential trade actions, and the ongoing tech revolution, there's a lot to keep track of.

Key Takeaways for Investors

Stay vigilant, do your research, and don't let emotions drive your decisions. The key to success in this environment is to remain calm, informed, and adaptable.

Conclusion: Navigating the Economic Maze

Today's Daily Open paints a picture of an economy walking a tightrope. The Fed is concerned about stagflation fueled by tariffs, the markets are cautiously optimistic, and technology continues to disrupt the status quo. Trump's looming announcement adds another layer of uncertainty. Remember, the best strategy is to stay informed, be flexible, and prepare for anything. The economic maze is complex, but with the right tools and knowledge, you can navigate it successfully.

Frequently Asked Questions

Here are some frequently asked questions about the topics discussed in today's CNBC Daily Open:

1. What is stagflation and why is it bad?

Stagflation is a combination of stagnant economic growth and rising inflation. It's bad because it reduces purchasing power, increases unemployment, and makes it difficult for policymakers to address the issues.

2. How do tariffs contribute to stagflation?

Tariffs can raise prices for consumers and businesses, contributing to inflation. They can also reduce trade and economic activity, leading to slower growth. If these two effects occur simultaneously, it can result in stagflation.

3. What are reciprocal tariffs and how do they work?

Reciprocal tariffs are trade measures where one country imposes tariffs on another country's goods in response to that country imposing tariffs on its goods. It's essentially a tit-for-tat trade war.

4. What are the potential implications of rescinding AI chip export restrictions?

Rescinding AI chip export restrictions could boost U.S. chipmakers' sales but also raise concerns about China's access to advanced technology for military applications, creating a tension between economic gains and national security concerns.

5. How could AI search engines replace standard search engines like Google?

AI search engines could offer more personalized, conversational, and intuitive search experiences by understanding user intent and anticipating needs, potentially making them more efficient and effective than traditional keyword-based search engines.