China AI: Nvidia CEO Warns They're Not Behind!

AI Race Heats Up: Nvidia's Jensen Huang Says China's a Contender

Introduction: The AI Power Shift is Here

The world of Artificial Intelligence (AI) is a battlefield of innovation, a high-stakes race where only the most cutting-edge technologies survive. And according to Nvidia's CEO, Jensen Huang, we shouldn't underestimate the competition. His recent statements have sent ripples through the tech industry, particularly concerning China's progress. Are they catching up? Are they already ahead in some areas? Let's dive into Huang's insights and explore what this means for the future of AI.

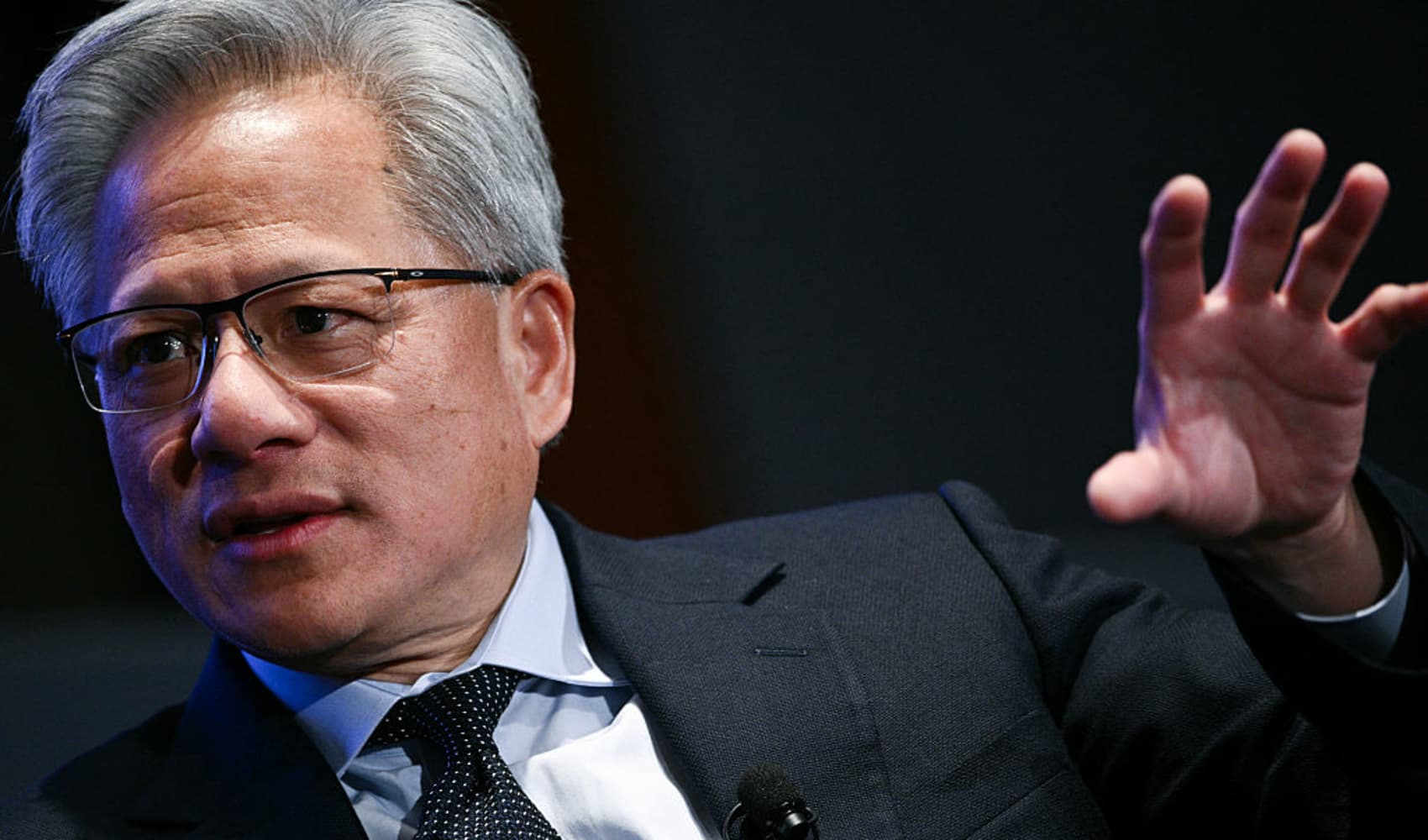

Jensen Huang's Warning: China is "Not Behind"

Speaking at a tech conference in Washington, D.C., Huang didn't mince words. "China is not behind" in artificial intelligence, he declared. This isn't just a casual observation; it's a significant assessment from the head of a company at the forefront of AI development. Why should we pay attention? Because Nvidia's chips power much of the AI innovation happening globally.

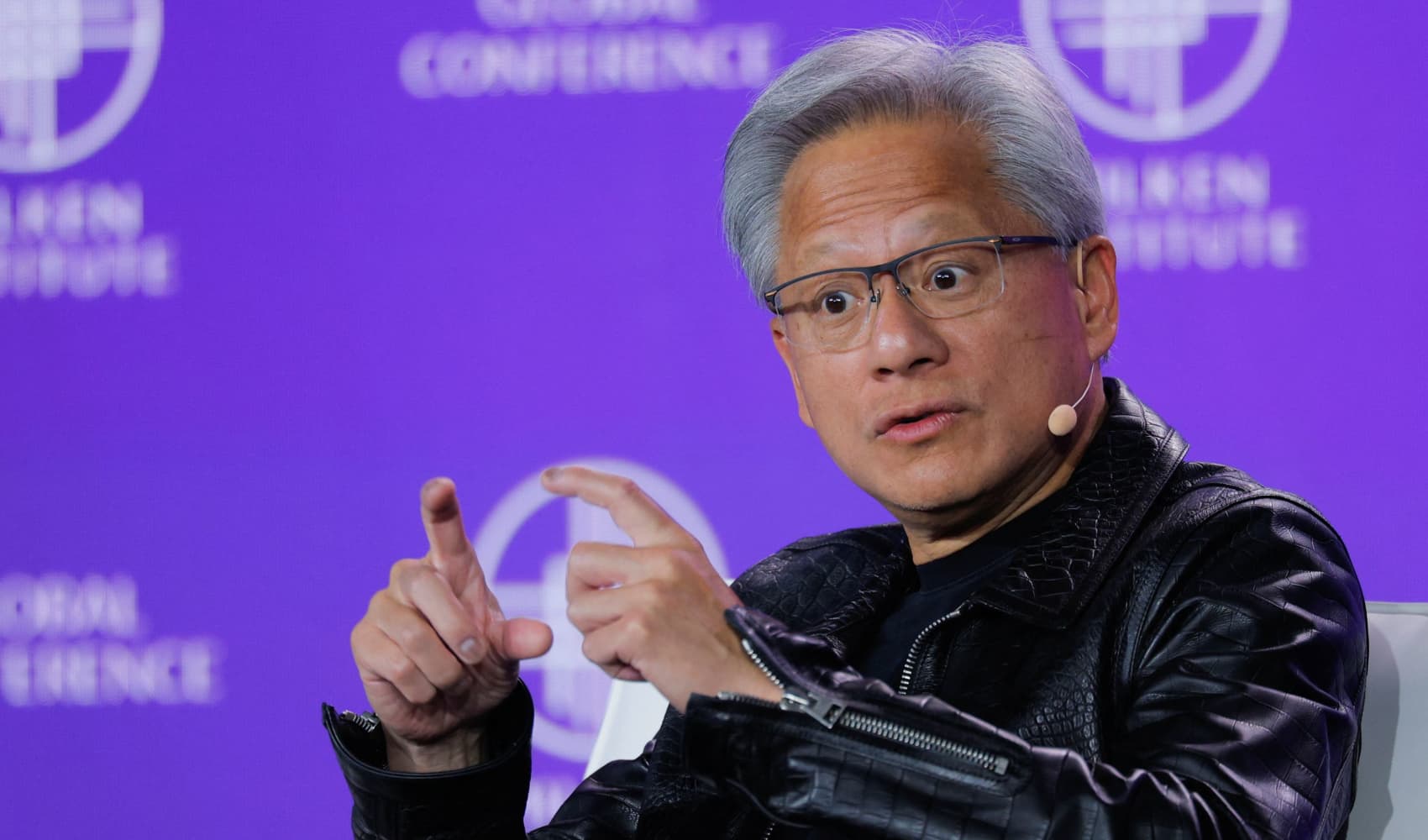

Huawei: A Formidable Competitor

Huang specifically called out Huawei as "one of the most formidable technology companies in the world." This acknowledgement highlights the strength and capabilities that China's tech sector brings to the AI table. But what makes Huawei so formidable? Let's break it down:

Technological Prowess

Huawei has invested heavily in research and development, leading to breakthroughs in 5G, telecommunications, and, increasingly, AI. Their ability to innovate and adapt is a key factor in their success.

Market Share

Even with international scrutiny and restrictions, Huawei maintains a significant market presence, particularly in China and other parts of Asia. This gives them a massive testing ground and user base for AI applications.

Government Support

The Chinese government's strategic focus on AI and its commitment to funding and supporting local tech companies undoubtedly bolster Huawei's position and accelerate its AI development.

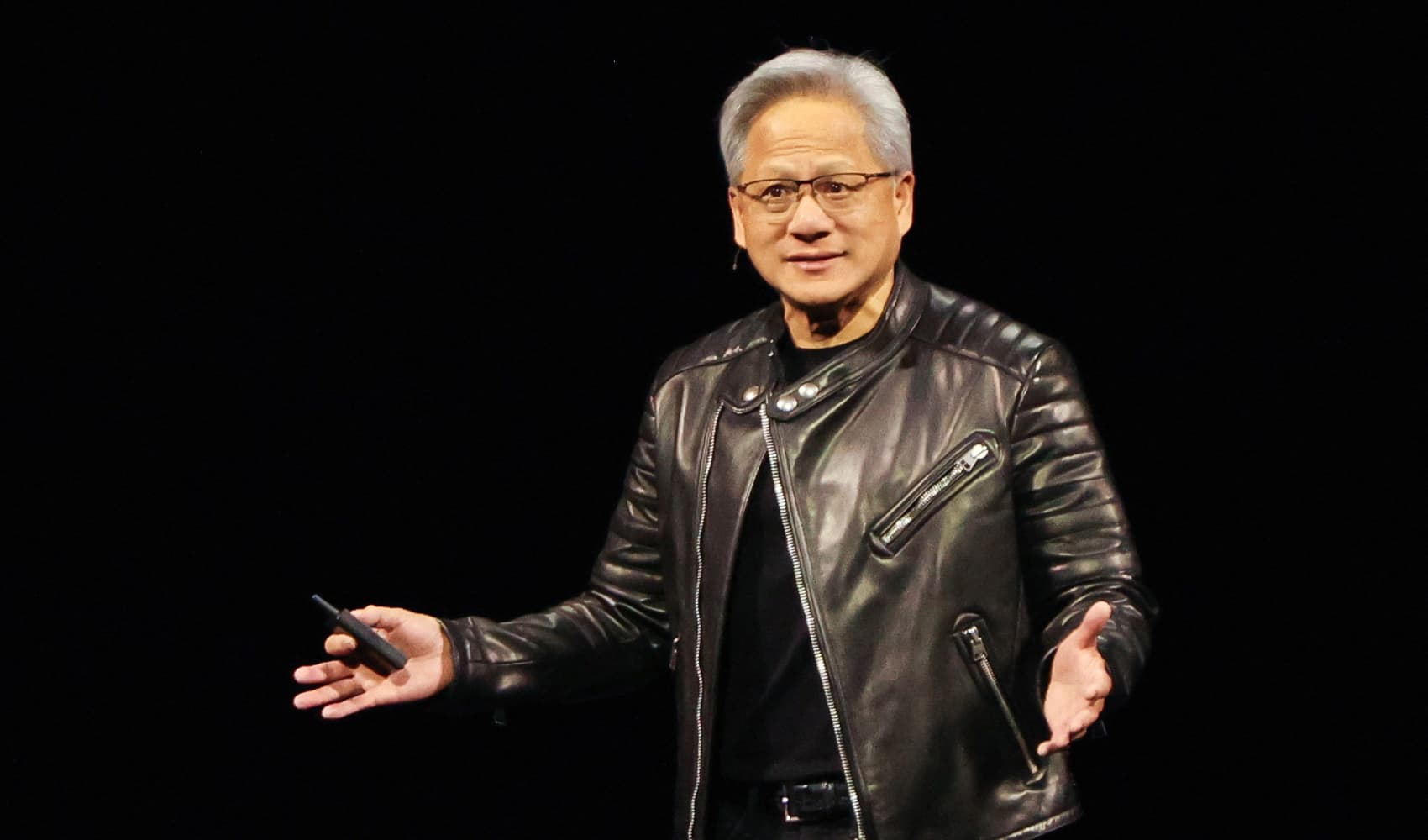

"Right Behind Us": The Narrowing Gap

Huang qualified his statement by saying China may be "right behind" the U.S. for now, but emphasized that it's a narrow gap. Imagine a marathon runner gaining rapidly on the leader – that's the image Huang paints. But what does this mean in practical terms?

The Long-Term Race: Infinite Innovation

"Remember this is a long-term, infinite race," Huang stated. This isn't a sprint; it's an endurance test. The constant innovation in AI means the leading edge is always shifting. Maintaining a competitive advantage requires continuous investment, adaptation, and a relentless pursuit of breakthroughs.

Beyond Hardware: The Software Equation

While Nvidia is renowned for its hardware, the AI race isn't solely about chips. Software, algorithms, and data are equally crucial. How does China fare in these areas?

Data Abundance

China's vast population and digital economy generate an enormous amount of data – the fuel that powers AI. This data advantage gives Chinese companies a significant edge in training AI models.

Algorithm Development

Chinese researchers and engineers are actively contributing to advancements in AI algorithms, particularly in areas like computer vision, natural language processing, and machine learning. Their research is not just catching up; in some areas, it's leading the way.

Applications and Adoption

China is rapidly deploying AI in various sectors, from smart cities and healthcare to finance and manufacturing. This widespread adoption provides valuable real-world feedback and drives further innovation.

The Impact of Geopolitical Tensions

Geopolitical tensions between the U.S. and China inevitably play a role in the AI race. Trade restrictions, export controls, and concerns about technology transfer can all impact the flow of innovation. But how much of an impact will this have on the pace of progress?

Competition Breeds Innovation

Some argue that competition between the U.S. and China in AI is ultimately beneficial, driving innovation and leading to faster progress. Think of it as a technological arms race, where each side pushes the other to achieve greater heights. The ultimate beneficiaries are consumers and society as a whole.

The Ethical Considerations

As AI becomes more powerful, ethical considerations become increasingly important. Concerns about bias, privacy, and the potential for misuse need to be addressed. Who will set the standards for ethical AI development?

Data Privacy

How will countries balance the need for data to train AI models with the protection of individual privacy? This is a critical question with far-reaching implications.

Algorithmic Bias

Ensuring that AI algorithms are fair and unbiased is essential to prevent discrimination and promote equitable outcomes. This requires careful attention to data collection, model design, and ongoing monitoring.

Responsible AI Development

Developing AI responsibly means considering the potential social, economic, and ethical impacts of this technology and taking steps to mitigate any negative consequences.

The Future of AI: A Collaborative Effort?

While competition is inevitable, collaboration may also be necessary to address global challenges like climate change, healthcare, and poverty. Can the U.S. and China find ways to cooperate on AI research and development?

Investing in the Future: Education and Talent

Ultimately, success in the AI race depends on investing in education, training, and talent development. Countries that can attract and retain the best AI researchers, engineers, and entrepreneurs will have a significant advantage. Are we doing enough to cultivate the next generation of AI experts?

Beyond National Borders: A Global Perspective

The AI race isn't just about the U.S. and China. Other countries, like the UK, Canada, and India, are also making significant strides in AI. A truly global perspective is needed to understand the full landscape of AI innovation.

The Bottom Line: Adapt or Be Left Behind

Huang's warning serves as a wake-up call. The AI landscape is constantly evolving, and complacency is not an option. Businesses and governments alike must adapt to the changing dynamics and invest in the future to remain competitive.

Conclusion: Embracing the AI Revolution

Jensen Huang's message is clear: China is a serious contender in the AI race, and Huawei is a force to be reckoned with. The U.S. can't afford to be complacent. Competition is fierce, innovation is rapid, and the stakes are high. To stay ahead, we need to invest in research, develop talent, and embrace a collaborative approach to solving global challenges. The AI revolution is here, and it's time to adapt or be left behind.

Frequently Asked Questions

Q1: Is China truly ahead of the US in any specific areas of AI?

A1: While the US may have an overall edge, China excels in AI applications leveraging large datasets, like facial recognition and computer vision, due to its massive population and data availability. They are also rapidly catching up in areas like natural language processing.

Q2: What specific challenges does the US face in maintaining its AI lead?

A2: The US faces challenges including securing sufficient funding for fundamental AI research, addressing ethical concerns around AI deployment, and overcoming talent shortages in key AI subfields. Competition for AI talent from other countries is also increasing.

Q3: How do export controls and trade restrictions impact China's AI development?

A3: Export controls on advanced chips and AI technologies can slow down China's progress by limiting access to cutting-edge hardware and software. However, they also incentivize China to develop its own domestic capabilities, fostering self-reliance and potentially accelerating innovation in the long run.

Q4: What role does open-source AI play in leveling the playing field?

A4: Open-source AI frameworks and tools provide a level playing field by democratizing access to AI technologies. This allows researchers and developers from all countries, including China, to contribute to and benefit from advancements in the field, regardless of their access to proprietary software.

Q5: Beyond the US and China, which other countries are emerging as significant AI players?

A5: Countries like the UK, Canada, Israel, and India are also making significant strides in AI research and development. Each country brings unique strengths, such as specialized expertise, strong academic institutions, and supportive government policies, contributing to the overall global AI landscape.