Student Loan Overhaul: GOP Plan Slashes Repayment Options

Student Loan Shakeup: Republicans Plan Drastic Overhaul

Introduction: Is College Affordability About to Change?

Big news out of Washington! The House Education and Workforce Committee Republicans have just dropped their proposal for a major overhaul of the student loan and financial aid system. Think of it as a financial makeover for higher education, but will it leave students looking runway-ready or simply broke? This plan, dubbed the Student Success and Taxpayer Savings Plan, aims to shake up everything from Pell Grant eligibility to the very repayment options available to borrowers. So, grab your calculators, folks, because we're about to dive deep into what this could mean for your future – or your already existing – student debt.

The Republican Vision: Fiscal Responsibility or Student Struggle?

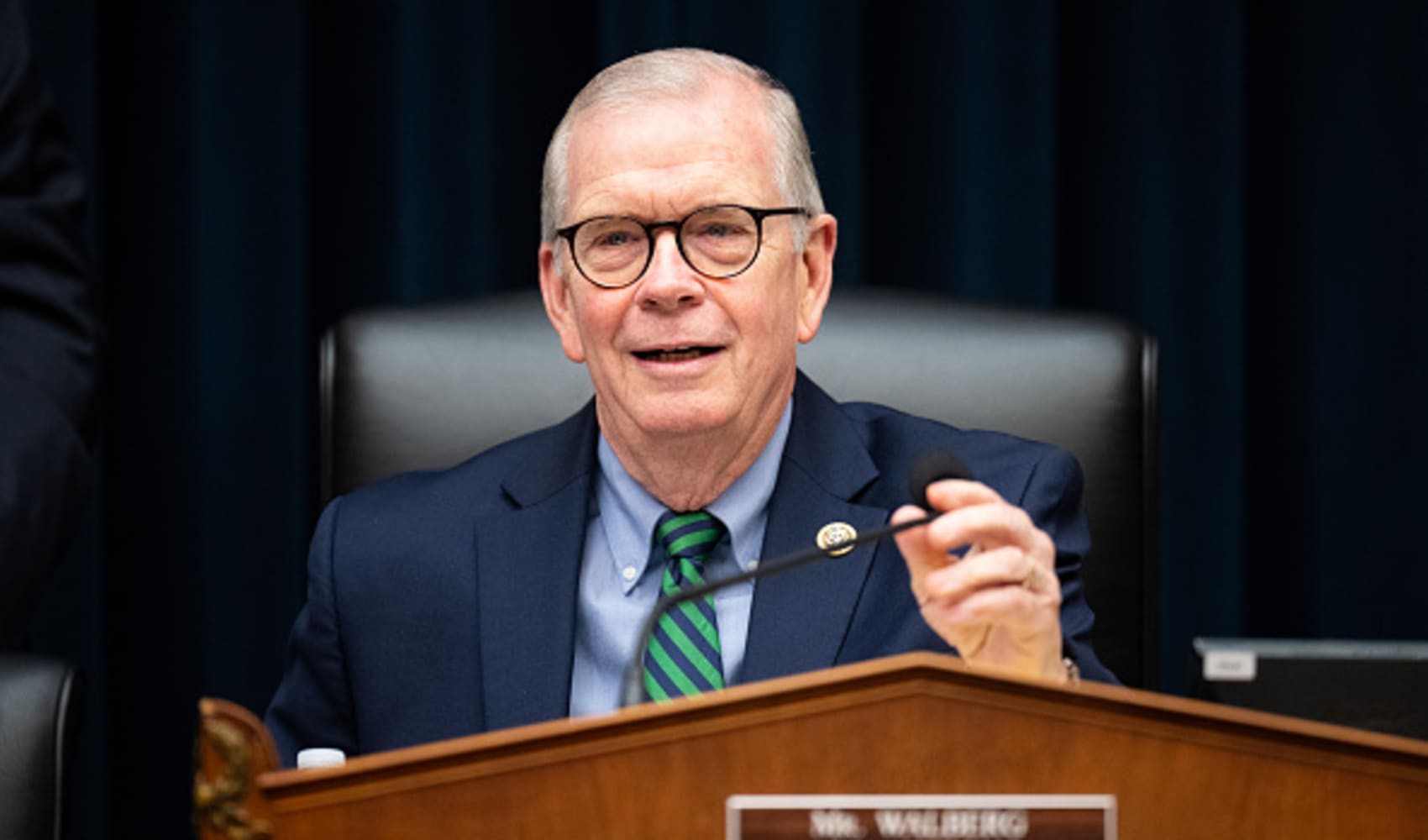

The GOP's stated goal is to tackle the "root causes of skyrocketing college costs," as Committee Chairman Tim Walberg put it. Their plan focuses on limiting student borrowing and reducing the number of repayment options, all under the banner of fiscal responsibility. But is this a genuine attempt to fix a broken system, or will it simply saddle future generations with even more financial burdens? Let's unpack the details.

Pell Grant Overhaul: New Requirements on the Horizon

Who Qualifies? Tightening the Belt on Pell Grant Eligibility

The Pell Grant, a cornerstone of federal financial aid for low-income students, is facing some significant changes. While the specifics are still being hammered out, expect to see stricter eligibility requirements. This could mean fewer students will qualify for this critical funding source, making college even less accessible for those who need it most. Are we about to see a two-tiered system where higher education becomes a luxury only the wealthy can afford?

What Does "Merit" Really Mean? The Potential for Performance-Based Grants

Rumors are swirling about incorporating some form of "merit" into the Pell Grant process. Now, “merit” can mean a lot of things. Will it be based on standardized test scores? High school GPA? Or something else entirely? Whatever the criteria, adding a merit-based component could disadvantage students from disadvantaged backgrounds who may not have access to the same resources as their more affluent peers.

Repayment Plan Restrictions: Fewer Options, Higher Payments?

Goodbye Flexibility? The Shrinking Landscape of Repayment Options

One of the most concerning aspects of the Republican plan is the proposed reduction in the number of student loan repayment options. Currently, borrowers have a variety of income-driven repayment (IDR) plans to choose from, which cap monthly payments based on their income and family size. The GOP aims to streamline this system, potentially eliminating some of these options and making it harder for borrowers to manage their debt.

Standardizing the System: A One-Size-Fits-All Approach?

The move toward standardization sounds good in theory – simplifying the system and making it easier to understand. But student loan debt is rarely a one-size-fits-all situation. Forcing borrowers into fewer repayment options could mean higher monthly payments for some, stretching their budgets thin and making it harder to make ends meet. Imagine trying to fit into a pair of jeans that are two sizes too small – uncomfortable, right?

The Impact on Borrowers: Who Wins, Who Loses?

The Winners: Taxpayers and… ?

The "Taxpayer Savings" part of the plan's name suggests that taxpayers will benefit from these changes. By reducing student loan debt and limiting borrowing, the GOP hopes to reduce the burden on taxpayers. But at what cost? Will the savings come at the expense of students' futures and the overall economy?

The Potential Losers: Low-Income Students and Graduates

The proposed changes could disproportionately affect low-income students and recent graduates struggling to find their footing in the job market. Stricter Pell Grant eligibility and fewer repayment options could create a perfect storm of financial hardship, making it harder for them to achieve their educational and career goals. We have to ask ourselves, is that the kind of future we want to create?

Addressing the Root Causes: A Band-Aid or a Real Solution?

The Real Culprit: Skyrocketing College Costs

The Republicans are right about one thing: the root cause of the student loan crisis is the skyrocketing cost of college. But does their plan truly address this issue? Simply limiting borrowing and reducing repayment options doesn't address the underlying problem of tuition inflation and the increasing cost of higher education. It's like treating the symptoms of a disease without addressing the underlying cause.

Looking Beyond the Loan: Alternative Solutions for Affordability

What about exploring alternative solutions like increased funding for public colleges and universities, tuition freezes, or innovative financing models? We need to think outside the box and find ways to make college more affordable without simply shifting the burden onto students and their families.

The Political Landscape: Will This Plan See the Light of Day?

A Partisan Battleground: The Road to Legislative Approval

Given the current political climate, it's unlikely that this plan will sail through Congress without significant opposition. Democrats are likely to push back against any measures that would restrict access to financial aid or make it harder for borrowers to manage their debt. Expect a heated debate and a long, drawn-out process before any of these changes become law.

The Role of the White House: Presidential Approval or Veto?

Even if the plan passes the House and Senate, it still needs presidential approval to become law. Depending on who occupies the White House, the fate of this legislation could be very different. The president's stance on student loan debt and higher education affordability will play a crucial role in determining the future of this plan.

Expert Opinions: What Are the Experts Saying?

Economic Implications: Experts Weigh In

Financial experts and economists have varying opinions on this proposed plan. Some argue that it's a necessary step towards fiscal responsibility and reducing the national debt. Others warn that it could have negative consequences for the economy, hindering economic growth and exacerbating income inequality. As with any complex policy proposal, there's no easy answer and a lot of room for debate.

Impact on Education: Will This Impact Future Generations?

Education experts are also weighing in on the potential impact of the plan on students and colleges. Concerns have been raised about the potential for decreased enrollment, particularly among low-income students. There's a real risk that these changes could create barriers to higher education, limiting opportunities for future generations.

What You Can Do: Taking Action and Staying Informed

Contact Your Representatives: Let Your Voice Be Heard

It's crucial to stay informed and let your representatives know your thoughts on this proposal. Contact your members of Congress and share your concerns or support for the plan. Your voice matters, and it's important to make sure your elected officials are hearing from their constituents.

Advocate for Change: Join the Conversation

Join the conversation online and in your community. Share your stories, connect with other students and graduates, and advocate for policies that support college affordability and student loan relief. Together, we can make a difference and shape the future of higher education.

Conclusion: A Student Loan Crossroads

The Republican plan to overhaul the student loan system represents a significant turning point in the debate over higher education affordability. While the stated goal is to address the root causes of the student loan crisis and protect taxpayers, the proposed changes could have far-reaching consequences for students and graduates. By limiting access to financial aid and reducing repayment options, the plan could create new barriers to higher education and exacerbate existing inequalities. It's up to us to stay informed, engage in the debate, and advocate for policies that support a more equitable and affordable future for all.

Frequently Asked Questions (FAQs)

Q1: What is the Student Success and Taxpayer Savings Plan?

A1: It's a Republican proposal to overhaul the student loan and financial aid system, aiming to limit student borrowing, reduce repayment options, and potentially add requirements to Pell Grant eligibility.

Q2: How would this plan affect Pell Grant eligibility?

A2: The plan proposes stricter eligibility requirements, possibly including a merit-based component, which could reduce the number of students who qualify for Pell Grants.

Q3: What changes are proposed for student loan repayment options?

A3: The plan aims to streamline the system, potentially eliminating some income-driven repayment plans and making it harder for borrowers to manage their debt.

Q4: Who would benefit most from this plan?

A4: The plan is intended to benefit taxpayers by reducing the burden of student loan debt, but its impact on students and graduates is a subject of debate.

Q5: How can I voice my opinion on this plan?

A5: Contact your members of Congress, share your thoughts on social media, and join advocacy groups that are working to address student loan debt and college affordability.