Global Trade Tensions: Bank of Korea's Grim Warning

Global Trade War Alert: Korea's Governor Warns "Bad for Everybody!"

Introduction: Is a Global Trade War Looming?

The world economy is a complex web, isn't it? A single thread pulled in one corner can unravel the entire tapestry. That's exactly what Bank of Korea Governor Rhee Chang Yong is warning us about when he says trade tensions are "bad for everybody." But what exactly does that mean, and how does it impact you and me?

Trade Tensions: A Recipe for Economic Disaster

Let's face it, trade wars aren't exactly new. But Governor Rhee's recent comments highlight the far-reaching consequences of these conflicts. He specifically mentioned the tariffs imposed by the United States and their direct and indirect impact on South Korea. It's not just about the U.S. and South Korea; it's about the entire global supply chain.

The Butterfly Effect of Tariffs

Think of it like this: a butterfly flaps its wings in Brazil, and it causes a tornado in Texas. A seemingly small tariff can disrupt production, raise prices, and ultimately hurt consumers worldwide. Governor Rhee pointed out that U.S. tariffs directly affect South Korea and indirectly impact them through things like semiconductor production in Vietnam, car and electronics production in Mexico, and even battery production in Canada. These interconnected industries are vulnerable when trade barriers go up.

South Korea Feeling the Pinch

The South Korean economy is highly dependent on international trade, which is why it's particularly sensitive to these global headwinds. Rhee specifically stated that trade tensions have created significant challenges for the South Korean economy, increasing downside risks to its economic growth. No one wants to see their economy slow down, right?

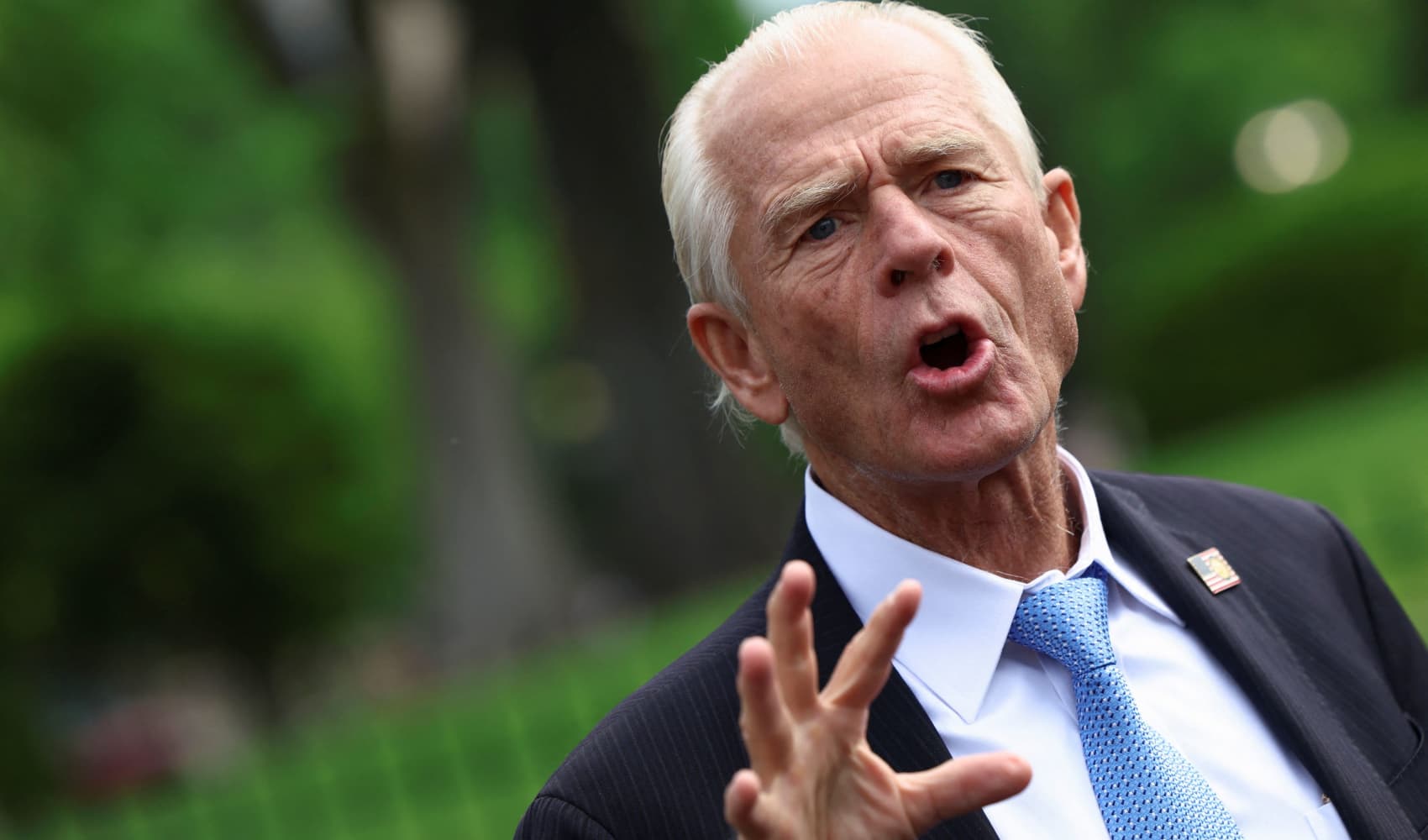

Trump's Tariffs: A Blast from the Past (and Maybe the Future?)

Governor Rhee specifically called out the tariffs initiated by former U.S. President Donald Trump. While some might argue about the effectiveness of these tariffs, the undeniable fact is that they created significant uncertainty and disruption in the global economy. The big question is: will these policies make a comeback?

The Semiconductor Saga: A Critical Component in the Trade War

Semiconductors are the brains behind almost every electronic device we use. From smartphones to cars to medical equipment, these tiny chips are essential. The mention of semiconductor production in Vietnam highlights the strategic importance of this industry in the global trade landscape. Disruptions in the semiconductor supply chain can have massive consequences for businesses and consumers alike.

Cars, Electronics, and Batteries: The Building Blocks of Modern Life

Mexico and Canada are key players in the automotive, electronics, and battery industries, respectively. Tariffs on these products can drive up costs for manufacturers and consumers. This is especially critical as we transition towards electric vehicles and rely increasingly on renewable energy sources.

Beyond Economics: The Geopolitical Implications

Trade tensions aren't just about money. They also have significant geopolitical implications. They can strain relationships between countries, create uncertainty, and even lead to political instability. The question is, how do we navigate these complex relationships in a way that benefits everyone?

The Hope for Resolution: A Plea for Calm

Governor Rhee's plea for the dissipation of trade tensions reflects a widespread desire for stability and cooperation in the global economy. He understands that protectionist measures, while perhaps appealing in the short term, can have devastating long-term consequences. "I really hope this trade tension will dissipate, because it's bad for everybody," he said.

Headwinds vs. Tailwinds: Which Way is the Wind Blowing?

In economic terms, "headwinds" are factors that hinder growth, while "tailwinds" are factors that promote it. Trade tensions clearly act as headwinds, slowing down economic progress and creating uncertainty. The goal is to create an environment where tailwinds can prevail, fostering growth and prosperity for all.

Protectionism vs. Free Trade: The Age-Old Debate

The debate between protectionism and free trade has been raging for centuries. Protectionism involves implementing tariffs and other barriers to protect domestic industries from foreign competition. Free trade, on the other hand, involves reducing or eliminating these barriers to promote international commerce. So, which is the better approach?

Arguments for Protectionism

Proponents of protectionism argue that it can protect domestic jobs, promote national security, and allow emerging industries to develop. They believe that tariffs can level the playing field and prevent unfair competition from foreign companies. But does this really work in practice?

Arguments for Free Trade

Advocates of free trade argue that it promotes economic growth, lowers prices for consumers, and encourages innovation. They believe that competition from foreign companies can drive efficiency and create new opportunities. It also helps consumers access a wider range of products at competitive prices. It's like a global bazaar, right?

The Role of Central Banks: Navigating the Storm

Central banks, like the Bank of Korea, play a crucial role in navigating economic storms. They can use monetary policy tools, such as interest rates and quantitative easing, to stabilize the economy and promote growth. But their power is limited, especially when faced with global trade tensions. They can't control what happens in other countries.

Investing in Uncertain Times: A Cautious Approach

Trade tensions create uncertainty, which can make investing more challenging. During these times, it's important to adopt a cautious approach, diversify your portfolio, and seek professional advice. Don't put all your eggs in one basket, as they say!

Looking Ahead: A Call for Cooperation

The global economy is interconnected, and cooperation is essential for achieving sustainable growth. Trade tensions are a threat to this cooperation, and it's up to policymakers to find solutions that benefit everyone. Governor Rhee's warning is a reminder that we're all in this together.

Conclusion: The Importance of Global Economic Harmony

Governor Rhee Chang Yong's words serve as a stark reminder of the dangers posed by trade tensions. The interconnected nature of the global economy means that tariffs and protectionist measures ultimately harm everyone, from consumers to businesses to entire nations. A cooperative and harmonious approach to international trade is essential for fostering sustainable growth and prosperity for all. Let's hope world leaders heed this warning and work towards a more stable and equitable global economic landscape.

Frequently Asked Questions (FAQs)

Q1: What are trade tensions and how do they arise?

Trade tensions are disagreements between countries regarding their trade policies. They often arise when one country imposes tariffs or other restrictions on imports, prompting retaliatory measures from other countries. These disagreements can stem from various factors, including concerns about unfair competition, protection of domestic industries, or national security.

Q2: How do trade tensions affect consumers?

Trade tensions can lead to higher prices for consumers due to tariffs on imported goods. When tariffs are imposed, businesses often pass these costs on to consumers, resulting in increased prices for everyday products. Additionally, trade tensions can reduce the availability of certain goods and services, limiting consumer choice.

Q3: What can governments do to resolve trade tensions?

Governments can engage in negotiations and dialogue to address the underlying issues that are causing trade tensions. They can also work together to establish clear and fair trade rules that promote competition and prevent unfair practices. Additionally, governments can seek mediation or arbitration from international organizations to resolve disputes.

Q4: How do trade tensions impact small businesses?

Small businesses are often particularly vulnerable to trade tensions as they may lack the resources to navigate complex trade regulations and absorb increased costs. Tariffs on imported materials or components can significantly increase production costs, making it difficult for small businesses to compete with larger companies. Additionally, reduced access to export markets can limit growth opportunities.

Q5: Can trade tensions ever be beneficial?

While generally harmful, some argue that trade tensions can, in certain limited circumstances, prompt countries to re-evaluate their trade practices and address unfair trade practices. They might also encourage domestic innovation and the development of new industries. However, the potential benefits are usually outweighed by the negative consequences of increased costs, reduced trade, and economic uncertainty.