S&P 500 & Nasdaq Surge: Tech Gains Fuel 3-Day Rally!

Tech Giants Power S&P 500 and Nasdaq to 3-Day High!

Introduction: A Bullish Breath of Fresh Air?

Feeling optimistic about the market? Well, you're not alone! Wall Street enjoyed a robust Thursday, with the S&P 500 and Nasdaq Composite closing higher for the third consecutive day. This bullish momentum was largely fueled by significant gains in heavyweight tech stocks. But is this a sustainable rally or just a temporary reprieve in a volatile market? Let's dive in and explore the key factors driving these gains.

S&P 500 and Nasdaq Soar: The Numbers Tell the Story

The numbers paint a clear picture of Thursday's market performance:

- S&P 500: Climbed 2.03% to reach 5,484.77

- Nasdaq Composite: Surged 2.74% to close at 17,166.04

- Dow Jones Industrial Average: Played catch-up, rising 486.83 points, or 1.23%, to 40,093.40. It's also worth noting that this marked the Dow's first close above 40,000 since April 15, which is definitely something to celebrate!

The Tech Titans Leading the Charge

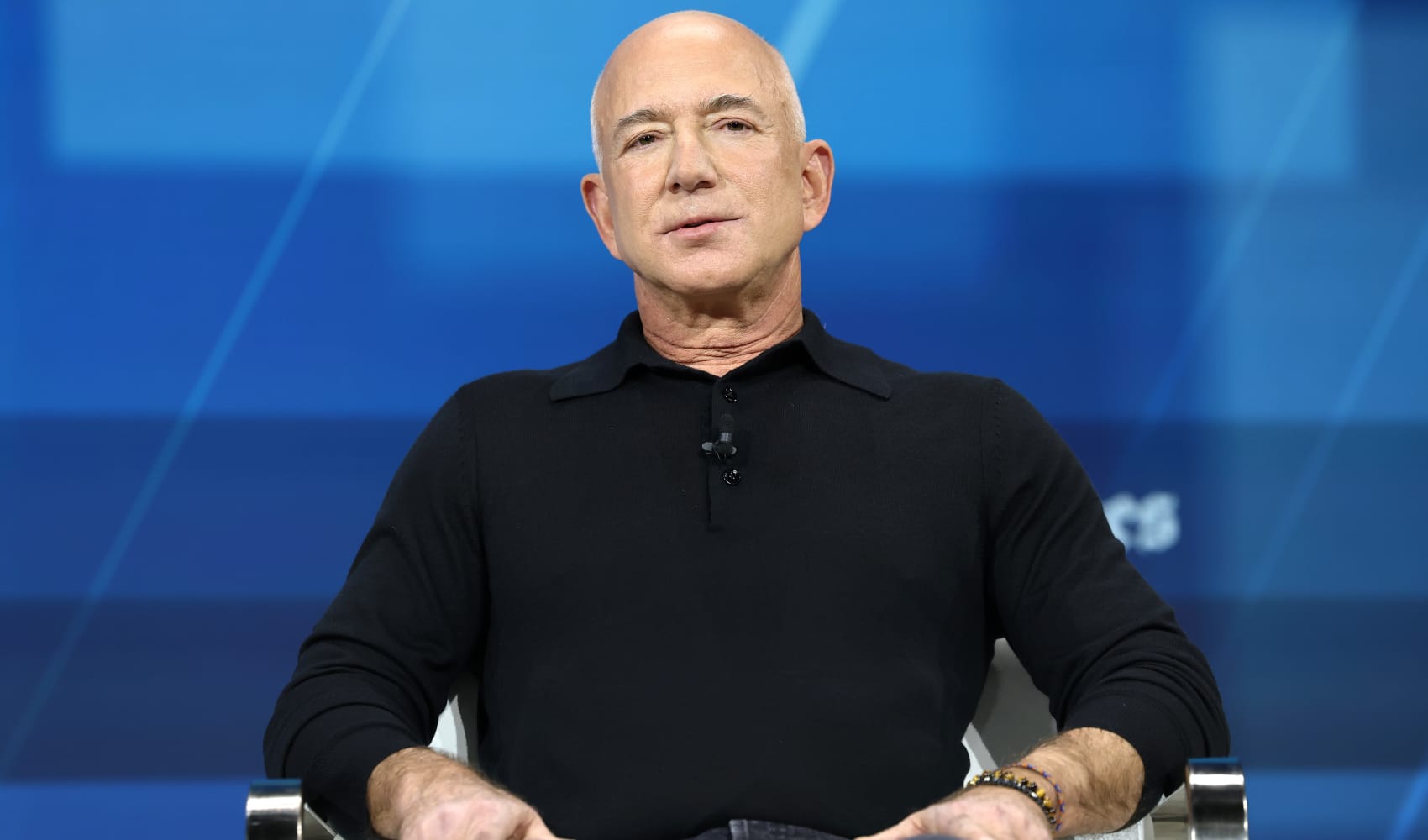

Which companies were the MVPs of this rally? The usual suspects, really – the megacap tech giants. Shares of Nvidia, Meta, Amazon, Tesla, and Microsoft all experienced significant gains, propelling the major averages upward. Think of them as the engines pulling the entire train up the hill.

IBM's Drag on the Dow: Not Everyone's a Winner

While most of the market was basking in green, IBM had a rough day. The stock plummeted 6.6%, weighing down the Dow Jones Industrial Average. This highlights the importance of diversification and how a single company's performance can impact an entire index. Every rose has its thorn, right?

Breaking Through the 40,000 Barrier: What It Means for the Dow

The Dow finally punched through the 40,000 level, a psychological milestone that hadn't been reached since mid-April. But what does it really mean? While symbolic, it can boost investor confidence and signal a potentially stronger market ahead. It's like finally reaching the summit after a long, arduous climb.

Trade Tensions and Tech: A Rocky Relationship

Tech stocks have been under pressure lately, partly due to escalating trade tensions, particularly between the U.S. and China. The White House's increasingly confrontational trade stance has dampened sentiment in the sector. It's like a dark cloud hanging over the sunny tech landscape.

China's Stance: No Trade Talks in Sight?

Adding fuel to the fire, China stated overnight that there were no trade talks currently taking place with the U.S. According to China’s Ministry of Commerce spokesperson He Yadong, “all saying…” (the statement was truncated, leaving some uncertainty). This ambiguity creates more uncertainty and volatility in the market.

Decoding the Market's Reaction: Why the Rally Despite Trade Concerns?

So, why did the market rally despite the trade concerns and China's statement? Several factors could be at play:

- Hopes for future negotiations: Investors might be betting that the lack of talks is temporary and that negotiations will eventually resume.

- Strong earnings reports: Continued strong earnings from tech companies could be overshadowing the trade concerns.

- Belief in government support: Faith in the government to support the markets.

The Importance of Earnings: Fundamental Strength Persists

Even amidst geopolitical uncertainty, solid earnings reports can provide a strong foundation for stock prices. Companies demonstrating robust revenue and profit growth can often weather market headwinds. Think of it as building a house on a solid foundation - it can withstand the storms.

Inflationary Pressures: The Elephant in the Room

We can't ignore the elephant in the room: inflation. While the recent market rally is encouraging, persistent inflationary pressures could still pose a threat. The Federal Reserve's response to inflation will play a crucial role in shaping the market's trajectory. Will they raise interest rates further, or will they hold steady?

Interest Rate Hikes: A Double-Edged Sword

Interest rate hikes can be a double-edged sword. On one hand, they can help curb inflation. On the other hand, they can slow down economic growth and potentially trigger a recession. Finding the right balance is crucial for the Fed. It's like walking a tightrope.

Looking Ahead: What's Next for the Market?

Predicting the future is impossible, but we can analyze the trends and potential scenarios. Keep an eye on trade negotiations, inflation data, and the Fed's monetary policy decisions. These factors will likely be key drivers of market performance in the coming weeks.

Navigating Volatility: Tips for Investors

Market volatility is inevitable. Here are a few tips for navigating these turbulent times:

- Stay diversified: Don't put all your eggs in one basket.

- Focus on the long term: Don't panic sell during short-term dips.

- Rebalance your portfolio: Regularly adjust your asset allocation to maintain your desired risk level.

- Consider consulting a financial advisor: Get personalized advice based on your individual circumstances.

The Power of Patience: Investing for the Future

Investing is a marathon, not a sprint. Patience and discipline are essential for long-term success. Don't let short-term market fluctuations derail your long-term goals. Think of it like planting a tree – it takes time for it to grow and bear fruit.

The Role of Technology: Shaping the Future of Finance

Technology continues to transform the financial landscape. From online trading platforms to robo-advisors, technology is making investing more accessible and efficient. Embrace the power of technology to enhance your investment strategies.

Conclusion: A Glimmer of Hope or a False Dawn?

The recent market rally, fueled by tech gains, offers a glimmer of hope for investors. However, it's crucial to remain cautious and monitor the key factors influencing the market, including trade tensions, inflation, and the Fed's policy decisions. Whether this rally is a sustainable trend or a temporary bounce remains to be seen.

Frequently Asked Questions

What caused the S&P 500 and Nasdaq to rise for three consecutive days?

The primary driver behind the three-day rally was strong performance from megacap tech stocks like Nvidia, Meta, Amazon, Tesla, and Microsoft. Investors were also hopeful about potential progress on global trade, even with mixed signals coming from China.

Why did IBM shares drop so significantly?

While the article itself doesn't provide specific reasons for IBM's drop, it is implied that company-specific news (possibly related to earnings, guidance, or industry trends) negatively impacted investor sentiment toward IBM.

Is it safe to invest heavily in tech stocks right now?

It's generally not advisable to invest heavily in any single sector. While tech stocks have shown strong performance, they are also susceptible to volatility, especially given ongoing trade tensions. Diversifying your portfolio is always a prudent strategy.

How will the Federal Reserve's decisions impact the market?

The Federal Reserve's monetary policy decisions, particularly regarding interest rates, have a significant impact on the market. Higher interest rates can curb inflation but may also slow down economic growth, while lower rates can stimulate growth but potentially fuel inflation. Investors closely watch the Fed's actions and statements to anticipate market movements.

What should I do if I'm worried about a potential market downturn?

If you're concerned about a market downturn, consider reviewing your investment strategy with a financial advisor. Diversifying your portfolio, focusing on long-term goals, and avoiding emotional investment decisions are all important steps to take during periods of market uncertainty.