S&P 500: Navigate Big Tech Earnings for Market Wins

S&P 500 Creeps Up Amid Big Tech Earnings Frenzy: What's Next?

Introduction: A Week of High Stakes

Hold onto your hats, folks! This week is shaping up to be a rollercoaster for Wall Street. The S&P 500 managed to eke out its fifth consecutive day of gains on Monday, but let's be honest, the market felt a little...jittery. Why? Well, a tidal wave of earnings reports from some of the biggest names in tech is about to crash down on us. Think of it like waiting for a storm – you know it's coming, but you're not quite sure how bad it will be. Add to that the ongoing murmurings about potential trade deals, and you've got a recipe for a week of high stakes and nail-biting anticipation.

The Market's Mixed Monday Performance

So, how did the major indices fare? Well, the S&P 500 edged up a mere 0.06%, closing at 5,528.75. Not exactly a barn burner, but hey, a win is a win, right? The Nasdaq Composite, on the other hand, dipped slightly, losing 0.1% to end at 17,366.13. The Dow Jones Industrial Average provided a bit of sunshine, climbing 114.09 points, or 0.28%, to settle at 40,227.59. It's like a mixed bag of candy – some sweet, some not so much.

Big Tech's Pre-Earnings Nerves

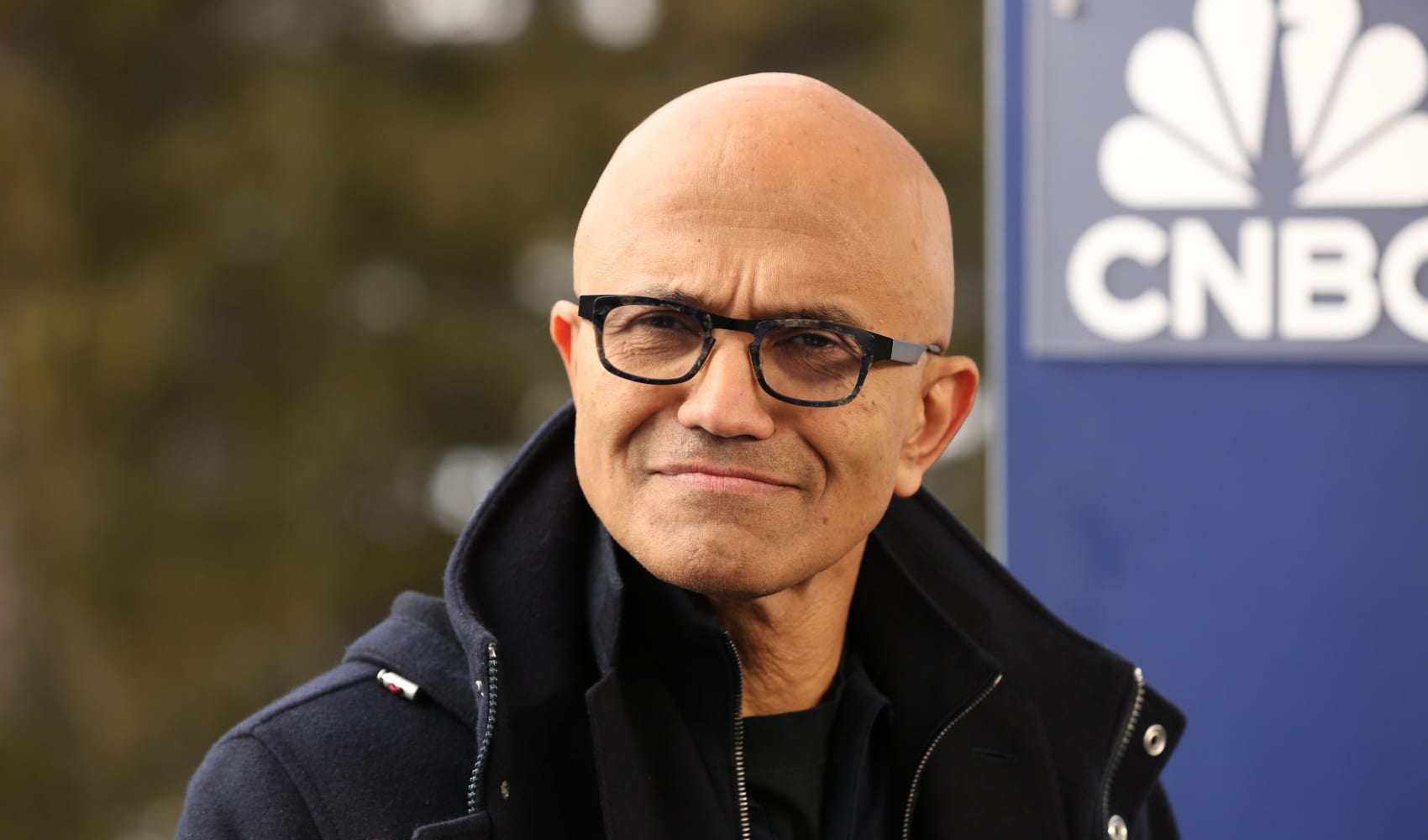

The "Magnificent Seven" – Amazon, Apple, Meta Platforms, Microsoft, and the rest – are the giants that often dictate the market's direction. And yesterday, even they seemed to be feeling the pre-earnings pressure. Let's break it down:

Magnificent Seven: A Tale of Two Halves

- Apple and Meta Platforms: Managed to finish modestly higher, both up around 0.4%. Maybe they're feeling confident?

- Microsoft and Amazon: Showed a little more vulnerability, slipping 0.2% and 0.7% respectively. Could be some profit-taking, or perhaps some pre-emptive caution.

Earnings Season: So Far, So Good (Mostly)

Earnings season is like a report card for Corporate America. So far, the results have been...okay. Around 73% of companies reporting have beaten analysts' estimates, which sounds good, right? But here's the catch: that's slightly below the 5-year average of 77%, according to FactSet data. Think of it as getting a B+ when you usually get an A – still good, but not quite up to par.

The Impact of Inflation Data

Beyond earnings, all eyes are on inflation data coming out later this week. Inflation is like the ghost that haunts the market. If it cools down, it gives the Fed room to potentially cut interest rates, which is generally seen as positive for stocks. If it stays stubbornly high, well, buckle up.

Inflation's Effect on Interest Rates

- Lower Inflation: Potential for interest rate cuts.

- Higher Inflation: Continued hawkish stance from the Fed.

Trade Deal Negotiations: A Constant Undercurrent

Remember those trade deal negotiations we mentioned? They're always lurking in the background, like a subplot in a long-running TV series. Any hint of progress could give the market a boost, while any signs of breakdown could trigger a sell-off. It's a geopolitical chess game that investors are constantly monitoring.

The VIX: A Measure of Market Fear

The VIX, often referred to as the "fear gauge," is an index that measures market volatility. Keep an eye on it this week. A rising VIX usually indicates increased uncertainty and potential for market swings.

Small Caps vs. Large Caps: A Diverging Path?

It's worth paying attention to the performance of small-cap stocks versus large-cap stocks. Small caps are often seen as a barometer of economic health. If they're underperforming, it could signal concerns about future growth.

Sector Rotation: Where's the Money Flowing?

Keep an eye on which sectors are leading the market. Is it tech? Healthcare? Energy? The answer can tell you a lot about the current market sentiment and where investors see opportunity.

The Bond Market's Perspective

Don't forget about the bond market! Bond yields can provide valuable insights into investor expectations for inflation and economic growth. Rising yields often indicate concerns about inflation or a stronger economy, while falling yields can suggest the opposite.

Analyst Upgrades and Downgrades: A Whisper in the Wind

Pay attention to analyst upgrades and downgrades. While they shouldn't be the sole basis for your investment decisions, they can offer clues about which stocks are gaining or losing favor on Wall Street.

Looking Ahead: What to Watch This Week

So, what should you be watching for this week? Here's a quick checklist:

This Week's Key Events

- Big Tech Earnings: The main event! Pay close attention to the numbers and, more importantly, the outlooks.

- Inflation Data: Will it be a pleasant surprise or a nasty shock?

- Trade Deal News: Any whispers or pronouncements from the negotiating table?

- The VIX: Is fear rising or falling?

- Bond Yields: What are they telling us about the economy?

Staying Calm in the Storm

With all this uncertainty swirling around, it's important to stay calm and avoid making rash decisions. Remember that long-term investing is a marathon, not a sprint. Don't let short-term market fluctuations derail your overall financial plan.

Remembering the Fundamentals

While the market can be swayed by sentiment in the short term, ultimately, company fundamentals matter. Focus on investing in companies with strong balance sheets, solid growth prospects, and capable management teams. These are the companies that are most likely to weather any market storm.

The Importance of Diversification

Never put all your eggs in one basket. Diversification is key to managing risk. Spread your investments across different asset classes, sectors, and geographies. This can help to cushion your portfolio against market downturns.

Conclusion: Navigating the Earnings Maze

The S&P 500's modest gain on Monday was just the appetizer. This week, we're diving headfirst into a feast of Big Tech earnings, closely watching inflation data, and keeping an ear to the ground for any trade deal developments. Stay informed, stay patient, and remember that market volatility is a normal part of investing. Don't panic, don't overreact, and focus on your long-term goals. It's going to be a wild ride, but with a clear head and a steady hand, you can navigate the earnings maze and come out on top.

Frequently Asked Questions

Here are some frequently asked questions to help you understand the market dynamics better:

- Why is Big Tech earnings season so important? Big Tech companies have a massive impact on the overall market due to their large market capitalizations and influence on various sectors. Their earnings reports can significantly impact market sentiment.

- How does inflation data affect the stock market? Lower inflation suggests the Federal Reserve might lower interest rates, making borrowing cheaper and boosting economic activity. Higher inflation might lead to continued high interest rates, potentially slowing economic growth.

- What are trade deal negotiations and why should I care? These are discussions between countries about trade agreements. Positive progress can boost investor confidence and potentially lead to increased economic activity, while breakdowns can create uncertainty.

- What does a rising VIX indicate about the market? A rising VIX suggests increased market volatility and fear among investors. It often signals a potential market downturn.

- How can I prepare for potential market volatility this week? Review your portfolio, ensure it's well-diversified, and avoid making impulsive decisions based on short-term market movements. Stick to your long-term investment strategy.