Stock Market Thursday: 5 MUST KNOW Before Trading Opens

Stock Market Thursday: 5 Things You MUST Know Before Trading Opens!

Ready to Conquer the Market? Your Thursday Prep Starts Here!

Alright, fellow investors, are you ready to tackle another day in the wild world of the stock market? Thursday's shaping up to be interesting, and you know what that means: opportunities galore! But to seize those opportunities, you need to be informed. So, grab your coffee, settle in, and let's dive into the five crucial things you need to know before the opening bell rings. Think of this as your pre-market playbook – your secret weapon for navigating the day ahead!

1. High Hopes... But Temper Your Expectations

Riding the Wave of Optimism

The markets enjoyed a solid Wednesday, posting gains across the board. The Dow Jones Industrial Average climbed 419.59 points, or 1.07%, after a particularly dramatic climb, even briefly surpassing 1,100 points higher. The S&P 500 also saw a 1.67% increase, and the Nasdaq Composite rallied 2.50%. These positive moves were largely fueled by renewed hopes of easing tensions in the ongoing U.S.-China trade relationship.

The Reality Check: Don't Get Carried Away

However, here's the crucial caveat: while the optimism is palpable, remember that markets can be fickle. They might have closed strong, but the major indexes closed well off their highs. This suggests a degree of uncertainty lurking beneath the surface. Are these gains sustainable, or are they a temporary blip? It's like seeing sunshine after a week of rain – exciting, but don't pack away your umbrella just yet! So, be cautiously optimistic and keep a close eye on market sentiment throughout the day. Focus on making informed decisions based on solid analysis, not just riding the wave of hype.

2. Google's Return-to-Office Mandate: A Ripple Effect?

The Tech Titan's Decision

Google, a bellwether for the entire tech industry, is tightening its return-to-office policy. The company is now requiring some employees to return to physical offices. This decision is significant for several reasons. First, it signals a potential shift in the broader tech landscape, where remote work has become increasingly prevalent. Second, it could impact the real estate market in areas where Google has a significant presence.

Beyond Google: What Does This Mean for Other Companies?

Think of Google as the trendsetter. Its actions often influence other companies, large and small. Will other tech giants follow suit? Will this trend extend beyond the tech sector? These are crucial questions investors need to consider. The move could impact productivity, employee morale, and even the overall demand for commercial real estate. Keep an eye out for announcements from other major companies regarding their return-to-office policies. Their decisions could create ripples throughout the market.

3. Corporate Earnings Season: Still in Full Swing!

The Earnings Rollercoaster Continues

Corporate earnings season is still in full swing, which means a steady stream of new information that can dramatically impact stock prices. Companies across various sectors are reporting their financial results, and these reports provide valuable insights into the overall health of the economy.

Decoding the Numbers: What to Watch For

Don't just look at the headline numbers (earnings per share and revenue). Dig deeper! Pay attention to guidance for future quarters, analyst calls, and any unexpected announcements. Are companies exceeding expectations, meeting them, or falling short? How are they addressing supply chain issues, inflation, and rising interest rates? These factors can significantly influence investor sentiment and stock valuations. Do your homework and stay informed!

4. Political Donations and Corporate Social Responsibility: A Delicate Balance

Corporate Contributions to the Trump Campaign

News has surfaced regarding companies that donated significant sums to the Trump campaign. This raises complex questions about corporate social responsibility, political influence, and brand reputation.

The Impact on Brand Perception and Consumer Loyalty

In today's socially conscious environment, consumers are increasingly aware of the values and actions of the companies they support. Political donations can significantly impact brand perception and consumer loyalty. Some consumers may boycott companies that support political figures or causes they disagree with, while others may applaud such actions. Investors need to consider the potential impact of these donations on a company's bottom line and long-term sustainability. Is there a risk of backlash? Has the company adequately considered the public's sentiment regarding their political contributions?

5. Watching the U.S.-China Trade Talks: Will There Be a Breakthrough?

Geopolitical Tensions and Market Volatility

As we saw with Wednesday's market rally, any positive signals regarding U.S.-China trade relations can inject a significant dose of optimism into the market. Conversely, renewed tensions can trigger sell-offs and increased volatility. The ongoing trade talks are a major factor influencing market sentiment.

Keep an Eye on Key Indicators

Pay close attention to news reports regarding the trade talks. Look for concrete signs of progress, such as agreements on specific issues or the lifting of tariffs. Also, be mindful of any rhetoric that suggests a breakdown in negotiations. These indicators can provide valuable clues about the potential direction of the market. Consider the impact of any agreement on industries that are heavily reliant on trade between the two countries.

6. Inflation Data: Is the Beast Being Tamed?

Inflation Remains a Key Concern

Inflation has been a major concern for investors throughout the year. While recent data suggests that inflation may be cooling down, it remains elevated. Any new inflation data released on Thursday could significantly impact market sentiment and the Federal Reserve's monetary policy decisions.

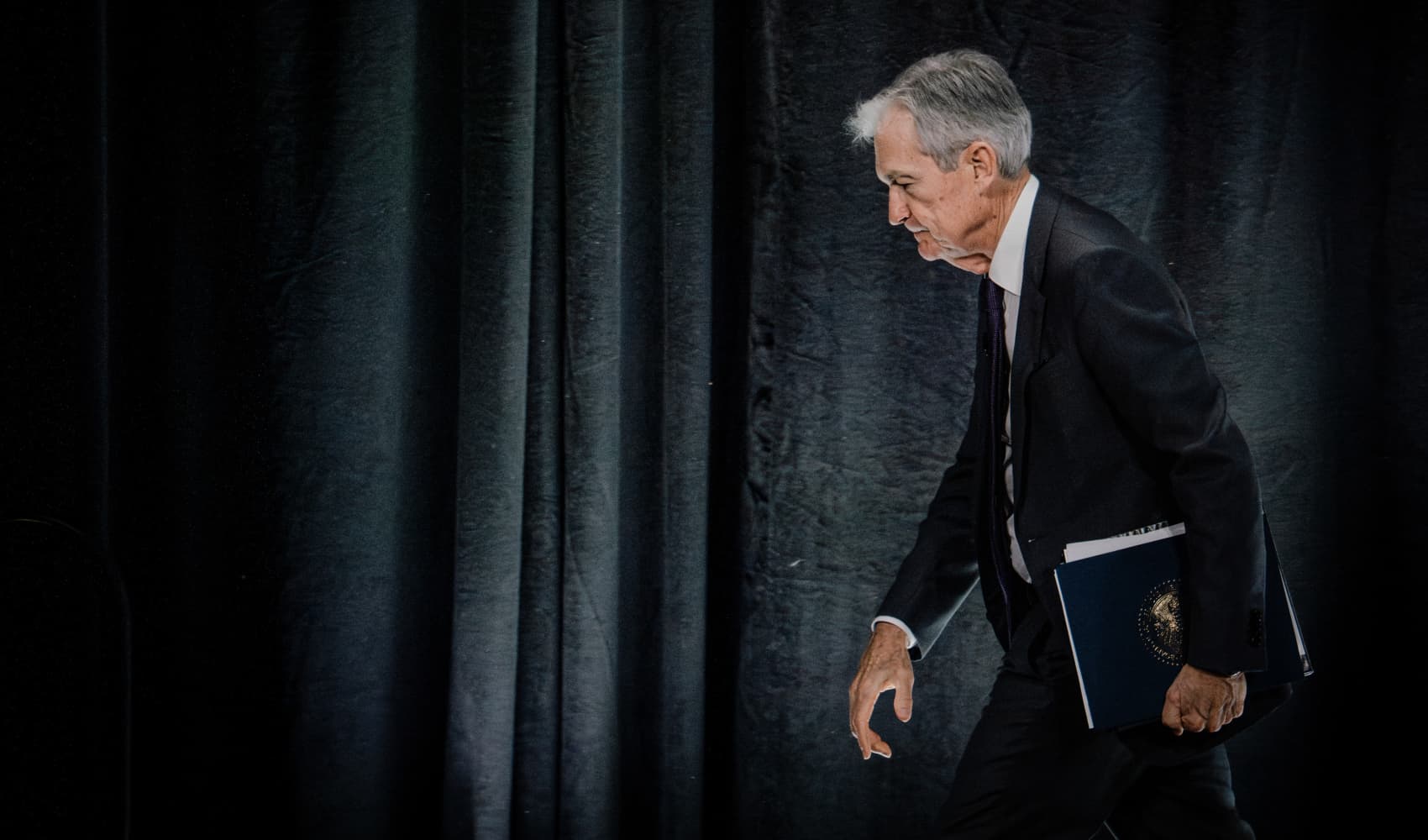

The Fed's Next Move

The Federal Reserve has been aggressively raising interest rates to combat inflation. Will they continue on this path, or will they take a more cautious approach? The answer to this question depends heavily on the latest inflation data. Investors should closely monitor any statements from Fed officials and analysts' interpretations of the data. Remember, the Fed’s decisions directly affect borrowing costs, impacting businesses and consumers alike.

7. Oil Prices: Supply, Demand, and Geopolitics

Crude Oil: A Volatile Commodity

Oil prices are notoriously volatile, influenced by a complex interplay of factors, including supply and demand dynamics, geopolitical tensions, and weather events. Keep an eye on oil prices as they can impact the energy sector and the overall economy.

Factors Influencing Oil Prices

Pay attention to news reports regarding OPEC production levels, geopolitical events in oil-producing regions, and demand forecasts. Also, consider the impact of the strong dollar, which can make oil more expensive for foreign buyers. Unexpected events, such as supply disruptions or increased demand, can trigger sharp price swings. Are we seeing increasing inventories or a drawdown? Are there any significant disruptions in production around the world?

8. Bond Yields: A Window into Market Expectations

The Bond Market's Message

Bond yields provide valuable insights into market expectations for inflation and economic growth. Monitor bond yields, particularly the 10-year Treasury yield, as they can signal changes in investor sentiment and potential shifts in monetary policy.

Yield Curve Inversion: A Recession Warning?

Pay close attention to the yield curve, which compares the yields of short-term and long-term bonds. An inverted yield curve, where short-term yields are higher than long-term yields, has historically been a reliable predictor of economic recessions. Is the yield curve flattening, steepening, or inverting? These signals offer a perspective on where professional investors believe the economy is heading. A deeply inverted yield curve can be a red flag.

9. The Housing Market: Cooling Down or Stalling?

Interest Rates and Housing Affordability

The housing market has been cooling down in recent months as rising interest rates have made it more expensive for people to buy homes. Keep an eye on housing market data, such as new home sales, existing home sales, and mortgage rates.

Leading Indicators: Inventory and Price Reductions

Pay attention to leading indicators, such as the number of homes on the market and the percentage of sellers who are reducing their prices. A significant increase in inventory or a widespread trend of price reductions could signal further weakness in the housing market. How is the market reacting to these shifts? Are sales volumes significantly dropping? Watch these metrics for insight into future price movements.

10. Cryptocurrency Market: Wildcard of the Day?

Bitcoin and Beyond

The cryptocurrency market remains a volatile and unpredictable asset class. Keep an eye on Bitcoin and other major cryptocurrencies, as they can sometimes influence the broader market sentiment.

Regulations and Adoption

Pay attention to news regarding regulations, institutional adoption, and technological developments in the crypto space. Major announcements can trigger significant price swings. Also, be mindful of any potential hacks or security breaches, which can negatively impact investor confidence. Is there positive regulatory news boosting confidence, or are we seeing further crackdowns?

11. Consumer Confidence: Are Shoppers Still Spending?

The Engine of the Economy

Consumer spending accounts for a significant portion of the U.S. economy. Monitor consumer confidence indices and retail sales data to gauge the strength of consumer spending.

Sentiment and Spending Habits

Pay attention to factors that can influence consumer sentiment, such as inflation, unemployment, and political uncertainty. Strong consumer spending is generally a positive sign for the economy, while weak consumer spending can signal a slowdown. Are consumers still willing to open their wallets, or are they tightening their belts in response to economic uncertainty?

12. Small Business Sentiment: A Barometer for Economic Health

The Backbone of the Economy

Small businesses are a major source of job creation and economic growth. Monitor small business sentiment surveys to gauge their confidence in the economy and their plans for hiring and investment.

Optimism vs. Pessimism

Pay attention to factors that can influence small business sentiment, such as access to capital, regulatory burdens, and labor costs. Strong small business sentiment is generally a positive sign for the economy, while weak sentiment can signal potential headwinds. Are small businesses feeling confident enough to expand, or are they holding back due to uncertainty?

13. Unexpected News: The Black Swan Events

Prepare for the Unexpected

The market can be easily swayed by unforeseen events. Always be prepared for unexpected news that could impact market sentiment and trading activity. These events, sometimes called "black swan" events, can range from geopolitical crises to natural disasters to surprising economic announcements.

Stay Alert and Adapt

Stay informed about global events and be ready to adapt your trading strategy as needed. Having a diversified portfolio can help mitigate the impact of unexpected events. Remember, flexibility is key in a constantly evolving market.

14. Pre-Market Movers: Identifying Potential Opportunities

Which Stocks are Making Waves?

Before the market opens, pay attention to pre-market movers – stocks that are experiencing significant price changes. Identify companies that are likely to be in focus when trading begins.

Understanding the Drivers

Understand the reasons behind the pre-market moves. Is it due to earnings announcements, news releases, or analyst upgrades? This information can help you make informed trading decisions when the market opens. Knowing *why* a stock is moving is as important as knowing *that* it's moving.

15. Your Trading Plan: Stick to Your Strategy!

The Foundation of Success

Before the market opens, review your trading plan and make sure you're prepared to execute it. Having a well-defined trading plan is essential for managing risk and maximizing profits.

Discipline and Focus

Stick to your strategy and avoid making impulsive decisions based on emotions. Remember, discipline and focus are key to successful trading. Don't let the market noise distract you from your goals. Trust your research and stick to your plan, even when things get volatile.

Conclusion: Your Thursday Market Checklist is Complete!

So, there you have it – your five (plus ten more!) essential things to know before the stock market opens on Thursday. Remember to stay informed, be cautious, and stick to your trading plan. This day promises to be full of opportunity, but only if you are prepared. We covered key aspects like U.S.-China trade talks, Google's return-to-office policy, the ongoing earnings season, the impact of political donations, and inflation concerns. Use this knowledge to make informed decisions and navigate the market with confidence. Good luck, and happy trading!

Frequently Asked Questions (FAQs)

- Why is it important to know what's happening before the stock market opens?

Being prepared with pre-market information can help you anticipate market trends, identify potential opportunities, and avoid knee-jerk reactions based on emotions. It gives you a competitive edge and allows you to make more informed trading decisions.

- How can I stay informed about pre-market news?

Subscribe to financial news outlets, follow market analysts on social media, and use trading platforms that provide pre-market data and analysis. Staying updated on key economic indicators and company announcements is crucial.

- What should I do if the market experiences a sudden drop?

Don't panic! Stick to your trading plan, assess the situation, and avoid making impulsive decisions. Consider diversifying your portfolio to mitigate risk. If you're a long-term investor, remember that market corrections are a normal part of the investment cycle.

- How does corporate earnings season affect the stock market?

Corporate earnings season can cause significant volatility in the stock market. Company earnings reports provide valuable insights into their financial performance, future outlook, and industry trends. Better-than-expected results can drive stock prices higher, while disappointing results can lead to sell-offs.

- How can I use economic data to make better investment decisions?

Economic data, such as inflation rates, unemployment figures, and GDP growth, provides valuable information about the overall health of the economy. Understanding these indicators can help you assess market trends, identify potential risks, and make more informed investment decisions. For example, rising interest rates often signal a cooling economy, which may impact certain sectors negatively.