Stock Market Wednesday: 5 Things Investors MUST Know!

Navigate Wednesday's Market Maze: 5 Things You MUST Know

Introduction: Gearing Up for a Pivotal Trading Day

Welcome, fellow investors, to the pre-market briefing! Are you ready for another day of Wall Street twists and turns? The market never sleeps, and neither should your preparation. Today, we're diving into five crucial factors that could significantly impact your portfolio as Wednesday unfolds. From trade talk whispers to the Fed's big reveal, let's get you armed with the knowledge you need to make informed decisions. Think of this as your pre-flight checklist before taking off into the potentially turbulent skies of the stock market.

1. Trade Talk Tease: Will This Time Be Different?

Hope Springs Eternal (Again?)

Stock futures are hinting at a positive open, fueled by the announcement that Trump administration officials will be meeting with their Chinese counterparts this weekend to discuss trade. But hold your horses before you jump on the bullish bandwagon! We've been down this road before, haven't we? Remember the numerous "breakthroughs" that fizzled out faster than a cheap firework? However, a spark of optimism is always welcomed, especially after Tuesday’s downpour.

Decoding the Diplomatic Dance

The devil, as always, is in the details. Keep a close eye on any official statements coming out of Washington and Beijing. Are they genuine efforts to de-escalate tensions, or just another round of political posturing? Any signs of progress, even small ones, could provide a much-needed boost to investor sentiment. Conversely, any hint of further deadlock could send the market tumbling.

2. Disney's Delight: Magic Kingdom Momentum

Earnings Enchantment

Mickey Mouse and company delivered some good news! Disney just announced its second-quarter earnings, exceeding both top- and bottom-line expectations. This is a big deal, as Disney is not just a media giant, but also a bellwether for the consumer economy. A strong performance from Disney suggests that consumers are still spending, which is a positive sign for the overall market.

Beyond the Numbers: What's the Real Story?

While the headline numbers are encouraging, delve deeper into the details. Was the growth driven by streaming subscribers, park attendance, or box office hits? Understanding the underlying drivers of Disney's success can give you valuable insights into broader consumer trends. Did Disney+ continue its torrid growth, or are subscriber numbers plateauing? These are the questions that smart investors are asking.

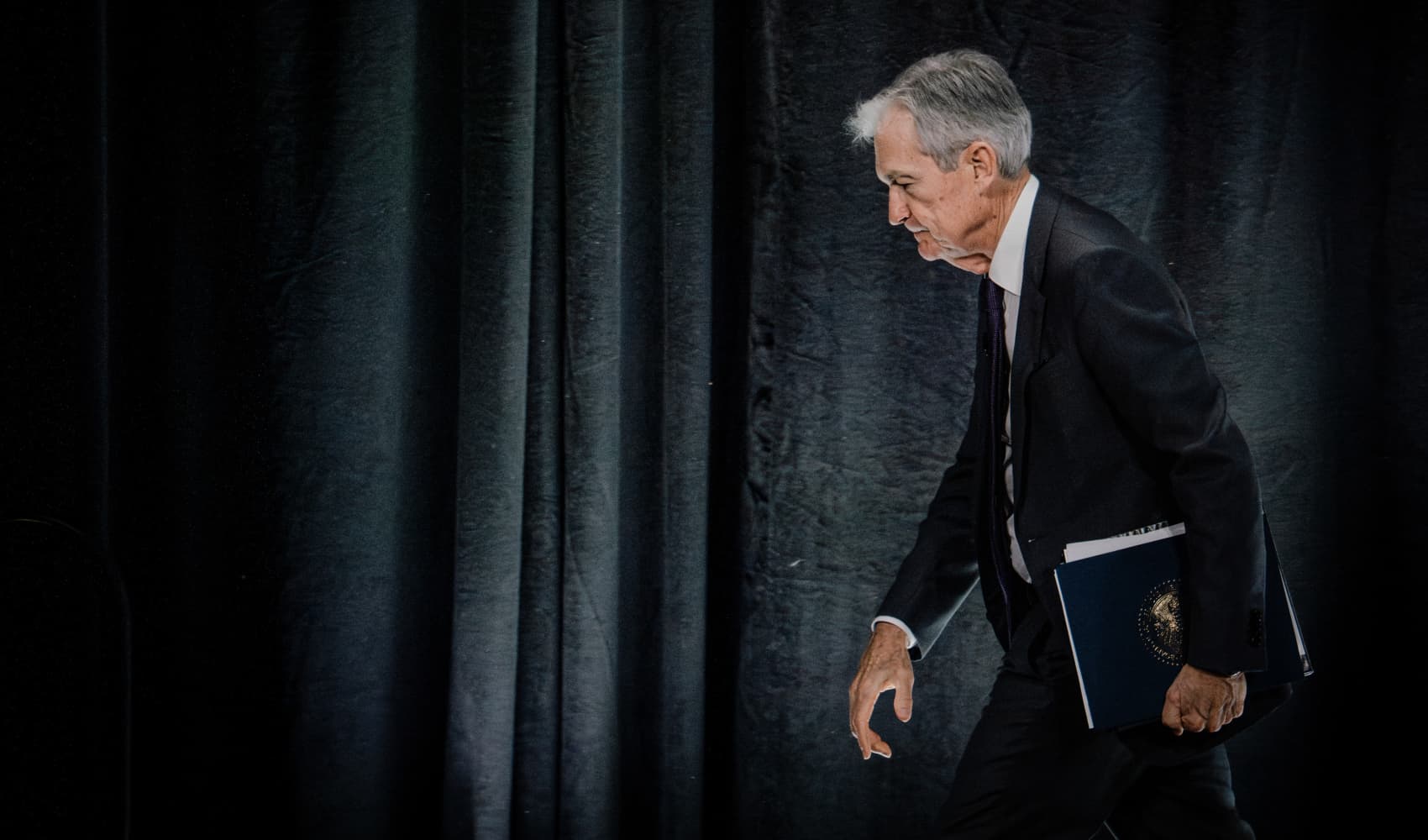

3. The Fed's Forecast: Waiting for the Rate Revelation

The Big Decision

Brace yourselves, because the Federal Reserve is set to announce its highly anticipated interest rate decision Wednesday afternoon. This is arguably the most important event of the day, as the Fed's actions can have a profound impact on the economy and the stock market. Will they hold steady, cut rates, or surprise us with a hike? Every word of the Fed's statement will be dissected and analyzed by investors around the world.

Decoding the Delphic Oracle

It's not just the rate decision itself that matters, but also the Fed's accompanying statement and press conference. Pay close attention to their assessment of the current economic conditions, their outlook for inflation, and their guidance on future policy moves. Are they signaling a more dovish (rate-cutting) or hawkish (rate-hiking) stance? Understanding the Fed's perspective is crucial for anticipating market movements. Think of the Fed as a pilot, adjusting the flaps on the plane that is our economy. The slightest adjustment can dramatically change the trajectory.

The Market's Reaction: Prepare for Volatility

Regardless of the Fed's decision, expect volatility in the market following the announcement. Traders will be scrambling to interpret the signals and adjust their positions accordingly. This could create both opportunities and risks for investors. Be prepared to react quickly and decisively, but avoid making rash decisions based on short-term market swings.

4. Economic Indicators: A Sneak Peek at the Economy

Beyond the Headlines

Keep an eye out for any economic data releases scheduled for Wednesday morning. These reports can provide valuable insights into the health of the economy and potentially influence the Fed's decision-making process. Key indicators to watch include inflation data, housing market reports, and consumer confidence surveys.

Connecting the Dots

Don't just look at the numbers in isolation. Try to understand how they fit into the broader economic picture. Are they consistent with the Fed's narrative, or do they suggest a different course of action? By analyzing economic data, you can gain a more informed perspective on the market's potential trajectory. If the data suggests a weakening economy, investors might anticipate the Fed to lower interest rates to encourage growth.

5. Global Geopolitics: Beyond the Trade War

The World Stage

While the US-China trade talks are dominating the headlines, don't forget about other geopolitical risks that could impact the market. Tensions in the Middle East, political instability in Europe, and rising nationalism in various parts of the world can all create uncertainty and volatility.

Staying Informed

Keep abreast of major geopolitical developments and assess their potential impact on your portfolio. Are there any upcoming elections or referendums that could disrupt markets? Are there any signs of escalating conflicts or trade disputes? Being aware of these risks can help you make more informed investment decisions. Global events are like pieces in a complex puzzle that can impact financial markets. Keep an eye on the horizon.

Conclusion: Navigating the Waters Ahead

So, there you have it – five key things to keep in mind before the stock market opens on Wednesday. Remember, the market is a dynamic and unpredictable beast. But by staying informed, being prepared, and thinking critically, you can increase your chances of success. Pay attention to trade talk developments, Disney’s performance, the Fed's rate decision, key economic indicators, and global geopolitical risks. Good luck, and happy investing!

Frequently Asked Questions

Q1: What is the most important thing to watch for regarding the US-China trade talks?

A1: Look for concrete details about the substance of the talks and any signs of genuine compromise. Vague statements and promises are not enough; we need to see real progress towards resolving the underlying issues.

Q2: How could a Fed rate cut affect my investments?

A2: A rate cut typically boosts stock prices by lowering borrowing costs for companies and stimulating economic growth. However, it could also weaken the dollar and potentially lead to inflation down the road.

Q3: Why is Disney's performance considered a bellwether for the economy?

A3: Disney's diverse business segments, including theme parks, movies, and streaming, provide a broad view of consumer spending habits. Strong Disney results often indicate a healthy consumer environment.

Q4: What should I do if the market becomes highly volatile after the Fed announcement?

A4: Avoid making impulsive decisions. Stick to your long-term investment strategy, rebalance your portfolio if necessary, and consider using stop-loss orders to protect your downside risk.

Q5: Where can I find reliable information about economic data releases?

A5: Reputable sources include the Bureau of Economic Analysis (BEA), the Bureau of Labor Statistics (BLS), and financial news outlets like Bloomberg, Reuters, and the Wall Street Journal. Also, check reports from banks and investment firms.