Trump's Tariffs: Bond Market Panic or Presidential Bluff?

Trump's Tariff Tango: Bond Market Jitters? He Says, "I Wasn't Worried!"

Introduction: The Art of the Deal... Or Just a Bluff?

Alright, let's dive into the swirling vortex of international trade, bond markets, and presidential pronouncements. President Donald Trump, never one to shy away from a bold statement, has dismissed any suggestion that bond market volatility influenced his decision to pause aggressive "reciprocal" tariffs earlier this month. Was it a strategic move, a calculated pause, or, as he claims, simply waiting for the "right numbers"? Let's unpack this, shall we?

The Tariff Pause That Raised Eyebrows

Earlier in April, the Trump administration announced a temporary hold on implementing those potentially disruptive across-the-board tariffs. This came after a noticeable sell-off in the bond market, sparking speculation that the market’s reaction might have played a role in the President's decision. But Trump, ever the contrarian, insists otherwise.

"I Wasn't Worried": Trump's Defiant Stance

"I wasn't worried," Trump declared in an interview with Time magazine, responding to questions about the financial market turmoil following his initial "Liberation Day" tariff announcement on April 2nd. This assertion begs the question: is it a genuine reflection of his confidence, or a carefully crafted narrative to project strength? After all, appearances matter in the world of high-stakes negotiations.

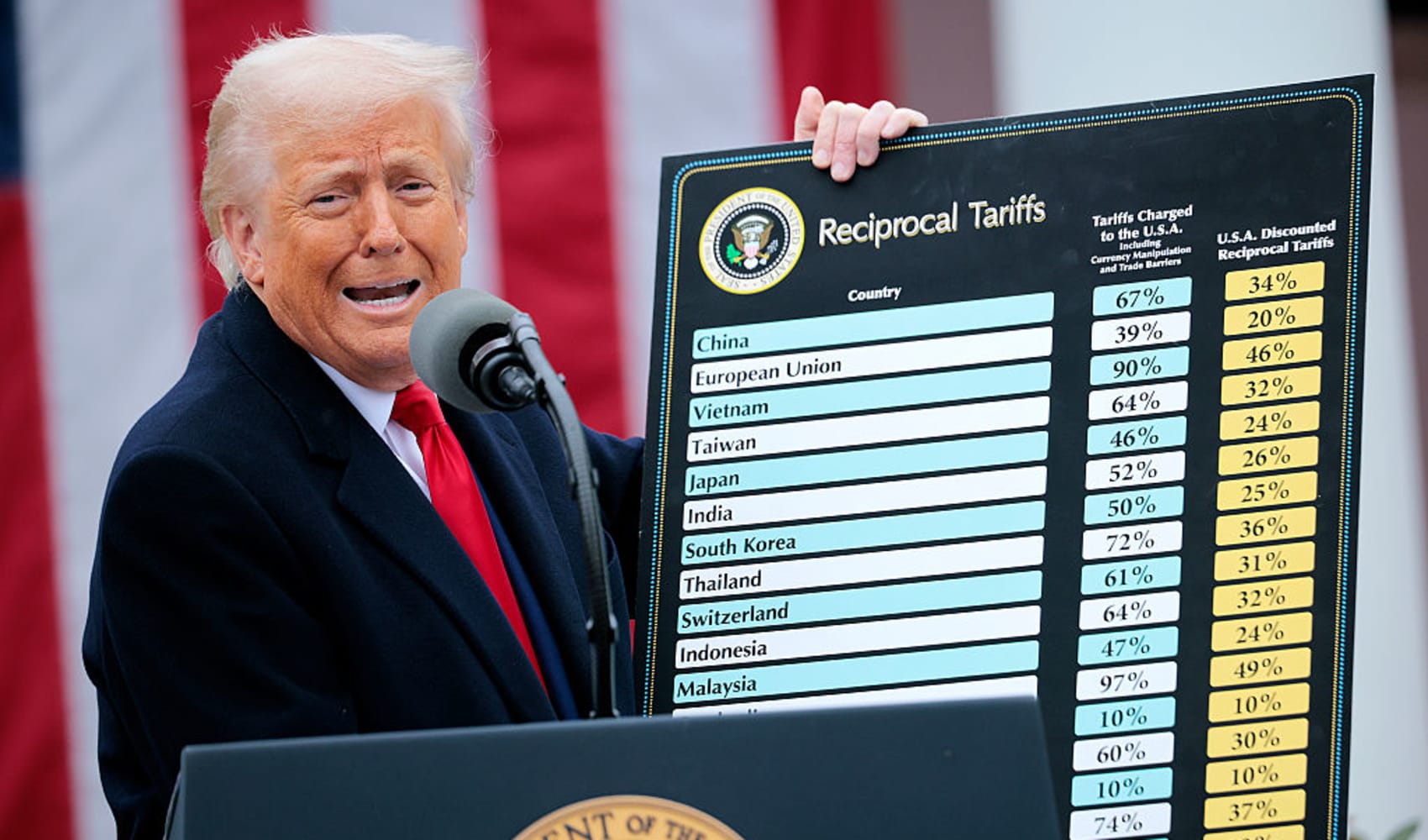

The "Liberation Day" Declaration: A Brief Recap

Let's rewind a bit. What exactly was this "Liberation Day" announcement that caused such a stir? Well, it involved a proposed 10% tariff on all U.S. imports, coupled with a detailed list of specific tariffs targeting numerous other nations. This move sent shockwaves through the global economy, triggering concerns about potential trade wars and inflationary pressures. Think of it as throwing a pebble into a pond – the ripples spread far and wide.

H2: Unpacking the "Numbers" Game

The Quest for Favorable Metrics

So, if the bond market wasn't a factor, what was? Trump claims he's waiting for the "numbers that I want to come up with." But what does this actually mean? Is he seeking specific economic data to justify the tariffs? Perhaps he's waiting for political leverage or aiming to exert pressure on trading partners. The ambiguity surrounding these "numbers" adds another layer of complexity to the situation.

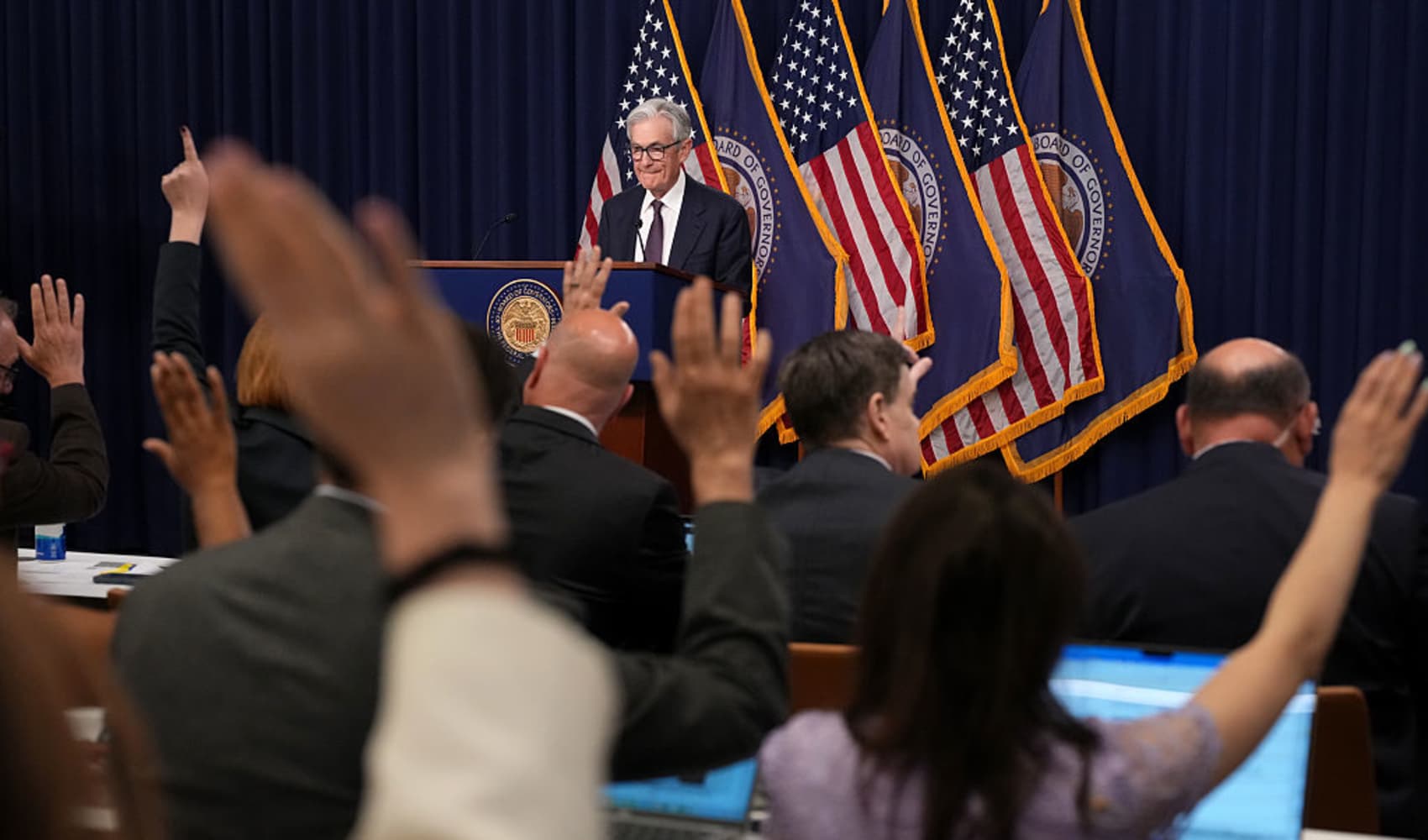

The Bond Market's Perspective: A Canary in the Coal Mine?

The bond market is often seen as a reliable indicator of economic sentiment. When investors flock to bonds, it typically signals concerns about future growth and stability. The recent sell-off in the bond market could suggest that investors were worried about the potential negative impact of aggressive tariffs on the U.S. and global economies. Is Trump ignoring a crucial warning sign?

H2: Reciprocal Tariffs: A Double-Edged Sword

Tit-for-Tat: The Risks of Retaliation

The concept of "reciprocal tariffs" sounds straightforward: if you impose tariffs on our goods, we'll do the same to yours. But this tit-for-tat approach can quickly escalate into a full-blown trade war, hurting businesses and consumers on both sides. Imagine two kids arguing, each throwing toys at the other – eventually, everyone gets hurt.

Political Ramifications: More Than Just Economics

Trade policy isn't just about economics; it's also deeply intertwined with politics. Trump's tariff decisions can have significant implications for international relations, domestic political support, and even his own legacy. Every move he makes is scrutinized and analyzed, not just by economists but also by political strategists around the world.

The Impact on American Businesses: Winners and Losers

Tariffs can create winners and losers within the American business community. Some industries might benefit from protection against foreign competition, while others could suffer from higher input costs and reduced export opportunities. It's a complex equation, and the overall impact on the U.S. economy is far from certain.

H2: Consumer Concerns: Will Prices Go Up?

The Cost of Protectionism: Who Pays the Price?

Ultimately, tariffs can affect consumers by raising the prices of imported goods. If companies have to pay more for raw materials or finished products from overseas, they're likely to pass those costs on to consumers. So, that new TV or pair of shoes might end up costing you more.

H2: Global Economic Fallout: A Butterfly Effect?

Trade Wars and Recession Risks

The potential for a global trade war is a serious concern. Escalating tariffs and retaliatory measures can disrupt supply chains, reduce global trade, and even trigger a recession. The interconnectedness of the modern global economy means that a trade conflict in one region can have ripple effects around the world. It's like a house of cards – one wrong move, and the whole thing collapses.

Alternative Explanations: Is There More to the Story?

While Trump insists the bond market didn't influence his decision, there could be other factors at play. Perhaps he received pushback from within his administration, or maybe he sensed a shift in public opinion. It's possible that a combination of factors, rather than a single event, led to the tariff pause.

The Role of Negotiation: A Calculated Tactic?

Some analysts believe that Trump's tariff threats are primarily a negotiating tactic. By imposing tariffs, he aims to put pressure on trading partners to come to the table and make concessions. It's a high-stakes game of brinkmanship, and the outcome is far from guaranteed.

What's Next? The Uncertain Future of Trade Policy

The future of U.S. trade policy remains uncertain. Will Trump ultimately implement the tariffs he initially proposed? Will he reach new trade agreements with key partners? Only time will tell. The world is waiting with bated breath to see how this trade drama unfolds.

H2: The Art of the Deal Revisited

Negotiating Tactics or Economic Reality?

Is President Trump a master negotiator leveraging tariffs for better trade deals, or is he underestimating the potential negative consequences of his actions? The answer, as with many things in the world of politics and economics, is likely somewhere in between. Only time will reveal the true impact of his tariff tango.

Conclusion: Decoding Trump's Trade Strategy

So, what have we learned? President Trump denies that bond market turmoil influenced his decision to pause aggressive tariffs. He claims he's waiting for the "right numbers." Whether this is a genuine reflection of his thinking, a negotiating tactic, or something else entirely remains unclear. The potential consequences of his trade policies – for American businesses, consumers, and the global economy – are significant and warrant close attention. The key takeaway is that trade policy is a complex and multifaceted issue, and the road ahead is paved with uncertainty.

Frequently Asked Questions (FAQs)

Here are some frequently asked questions about the recent tariff developments:

- Why did President Trump initially propose these tariffs?

President Trump stated that the tariffs were designed to address what he perceived as unfair trade practices by other countries and to protect American industries.

- What is the potential impact of tariffs on U.S. consumers?

Tariffs can lead to higher prices for imported goods, which could ultimately increase costs for U.S. consumers.

- How could a trade war affect the global economy?

A trade war could disrupt global supply chains, reduce international trade, and potentially lead to a slowdown in economic growth.

- What are "reciprocal tariffs," and how do they work?

Reciprocal tariffs are tariffs imposed by one country in response to tariffs imposed by another country. This tit-for-tat approach can escalate into a trade war.

- What alternative solutions could be used to address trade imbalances?

Alternative solutions include negotiating trade agreements, addressing currency manipulation, and promoting fair labor practices.

![Trump's Tariffs: 10% Is The New 0%? [Trade Deal Impact] Trump's Tariffs: 10% Is The New 0%? [Trade Deal Impact]](https://media.nbcnewyork.com/2025/05/108142925-1746717590884-gettyimages-2214072295-_mgl8748_w5i7tkks.jpeg?quality=85&strip=all)