China's Trade War Response: Targeted Business Aid Unveiled

China Doubles Down: Targeted Support to Buffer Trade War Blows

Introduction: Navigating the Storm

The global economic landscape is looking a bit like a stormy sea these days, isn't it? With geopolitical tensions swirling and trade winds shifting, businesses, particularly those caught in the crossfire of the U.S.-China trade war, are feeling the pressure. But China isn't just sitting back and watching. Beijing is actively planning a course of action, pledging to ramp up targeted support for businesses struggling under these "increased external shocks." Let's dive into what this means and how it might play out.

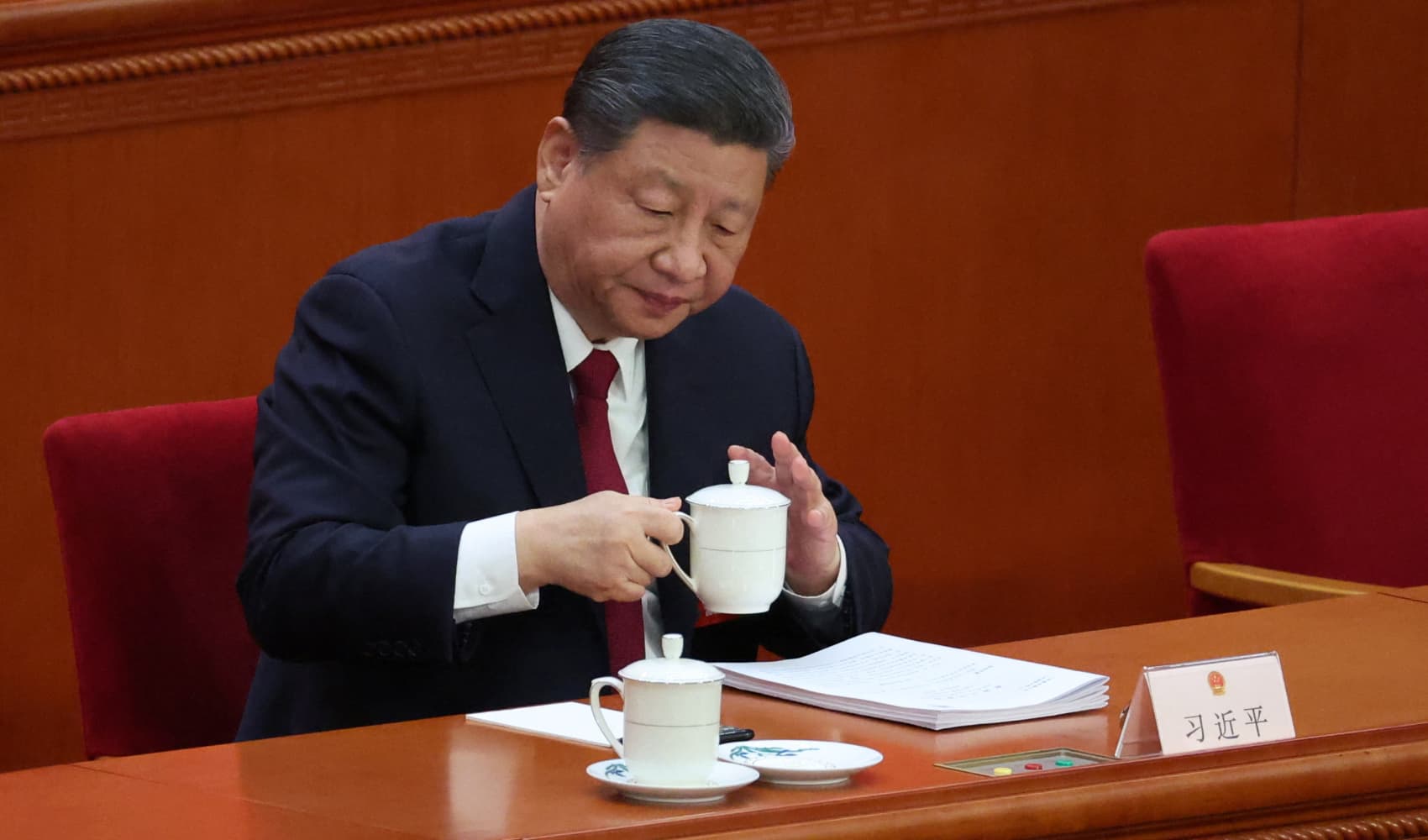

The Xi Jinping Announcement: A Lifeline in the Making

News broke recently following a Politburo meeting chaired by President Xi Jinping. The key takeaway? China is ready to step in and offer targeted assistance to businesses feeling the pinch. This isn't just empty rhetoric; it signals a potential shift towards a more proactive approach in shielding its economy from external pressures. Think of it as a doctor prescribing a specific treatment plan rather than a general wellness check-up.

Understanding "Targeted Measures"

What exactly does "targeted measures" mean? Well, it's likely to involve a combination of financial, regulatory, and administrative support tailored to the specific needs of different sectors and businesses. Imagine a tailor crafting a suit specifically to your measurements, rather than offering a one-size-fits-all garment.

Interest Rate and Reserve Requirement Ratio Adjustments

The Politburo meeting also highlighted the possibility of "timely reduction" of interest rates and the reserve requirement ratio (RRR). These are powerful tools that can inject liquidity into the economy and ease the financial burden on businesses.

The Power of Lower Interest Rates

Lower interest rates make borrowing cheaper, which can stimulate investment and consumption. It's like greasing the wheels of the economic engine, allowing it to run more smoothly and efficiently.

Reserve Requirement Ratio (RRR) Explained

The RRR is the percentage of a bank's deposits that it's required to keep in reserve. Reducing the RRR frees up more cash for banks to lend out, boosting credit availability. Think of it as unlocking a vault of potential funding for businesses.

Sticking to the Plan, But with Flexibility: The Zong Liang Perspective

According to Zong Liang, chief researcher at Bank of China, policymakers are sticking to their stance from earlier this year while maintaining flexibility for targeted measures. This suggests a commitment to a consistent overall strategy, but with the agility to adapt to evolving circumstances. It's like having a well-defined route on a map, but being prepared to take detours when necessary.

Washington-Beijing Tensions: The Catalyst for Action

The announcement comes as tensions between Washington and Beijing have escalated, making the need for proactive economic support even more pressing. The trade war has created uncertainty and disrupted supply chains, impacting businesses on both sides of the Pacific. It's like two heavyweight boxers trading blows, and the smaller businesses are caught in the fallout.

Potential Sectors to Benefit from Targeted Support

Which sectors are likely to receive the most attention? While the specific details remain to be seen, it's reasonable to expect that industries most affected by the trade war, such as manufacturing, technology, and agriculture, will be prioritized. Imagine these sectors being triage patients, with the most critical cases receiving immediate attention.

The Role of State-Owned Enterprises (SOEs) vs. Private Businesses

It will be interesting to see how the support is distributed between state-owned enterprises (SOEs) and private businesses. Will the government prioritize SOEs, or will it focus on fostering a level playing field for all businesses? This is a key question that will shape the long-term impact of these measures.

Impact on Foreign Investment: A Mixed Bag?

How will these measures affect foreign investment in China? On one hand, targeted support for businesses could make China a more attractive destination for investment. On the other hand, increased government intervention could raise concerns about regulatory risks and fair competition. It's a delicate balancing act.

A Global Perspective: Ripple Effects of China's Policy

China's economic policies have global implications. Any measures taken to mitigate the impact of the trade war will likely ripple through the global economy, affecting trade flows, commodity prices, and investment patterns. Think of it like dropping a pebble into a pond – the waves spread outwards, affecting everything in their path.

Beyond Financial Support: Regulatory and Administrative Relief

Targeted support isn't just about money. It could also involve streamlining regulations, reducing administrative burdens, and improving the business environment. Imagine cutting through red tape with a sharp pair of scissors, making it easier for businesses to navigate the bureaucratic maze.

Challenges and Opportunities Ahead

While China's pledge to ramp up targeted support is a positive step, there are challenges to overcome. Ensuring that the support is effectively targeted, avoiding unintended consequences, and maintaining transparency will be crucial for success. But also, this opens a new opportunity for businesses to re-strategize and align with the new government policies.

Ensuring Fair Distribution

One of the biggest challenges will be ensuring that the support is distributed fairly and efficiently, reaching the businesses that need it most. Preventing corruption and favoritism will be essential.

Avoiding Unintended Consequences

Another challenge is avoiding unintended consequences, such as creating market distortions or encouraging moral hazard. Policymakers will need to carefully consider the potential impacts of their actions.

The Long-Term Vision: Strengthening Economic Resilience

Ultimately, China's goal is to strengthen its economic resilience and reduce its reliance on external factors. This involves promoting innovation, upgrading industries, and expanding domestic demand. Think of it as building a more robust and self-sufficient economy that can weather future storms.

Conclusion: A Proactive Stance in Uncertain Times

In conclusion, China's pledge to ramp up targeted support for businesses is a significant development in the face of the ongoing U.S.-China trade war. This proactive stance, coupled with potential interest rate and RRR adjustments, signals a determination to shield its economy from external shocks and promote sustainable growth. While challenges remain, the commitment to flexibility and targeted measures offers a glimmer of hope for businesses navigating these turbulent times.

Frequently Asked Questions

Here are some frequently asked questions about China's plan to support businesses amidst the trade war:

- What are "targeted measures" and how will they differ from previous support programs?

Targeted measures imply a more tailored approach, focusing on specific sectors and businesses most affected by the trade war. Unlike broad stimulus packages, these measures will likely be designed to address the unique challenges faced by different industries.

- How can businesses apply for or access this targeted support?

The exact application process is still unfolding. However, businesses should monitor announcements from relevant government agencies, industry associations, and local authorities. Be prepared to demonstrate how the trade war has impacted your operations and financial performance.

- Will foreign-invested enterprises (FIEs) be eligible for the same support as domestic companies?

While the specific details haven't been released, it's generally expected that FIEs operating in China will be eligible for the same support as domestic companies, provided they meet the eligibility criteria. However, some sectors might be prioritized.

- How will the reduction in interest rates and the reserve requirement ratio directly benefit businesses?

Lower interest rates will reduce borrowing costs for businesses, making it easier to access credit for investment and expansion. A lower RRR will increase the amount of money banks can lend, improving overall credit availability.

- What are the potential risks associated with China's increased government intervention in the economy?

Potential risks include market distortions, reduced competition, and increased regulatory uncertainty. It's crucial that the government ensures transparency, fairness, and accountability in the implementation of these measures to mitigate these risks.