Volvo Stock Plummets: Cost Cuts, Guidance Cut - What's Next?

Volvo Cars in Crisis: Shares Plunge, Cost Cuts Loom

Introduction: A Speed Bump on the Road to Electrification?

Volvo Cars, the Swedish automaker renowned for its safety and increasingly, its electric ambitions, is facing a significant challenge. Imagine hitting a sudden, unexpected pothole on a smooth highway – that's the kind of shock the company is experiencing right now. Shares have taken a tumble following an announcement of lower-than-expected earnings and a sweeping cost-cutting initiative. But what's driving this downturn, and what does it mean for the future of Volvo?

The Numbers Don't Lie: Profit Dip and Guidance Withdrawal

The stark reality is this: Volvo Cars' operating profit in the first quarter plummeted to 1.9 billion Swedish kronor. Compare that to the 4.7 billion kronor from the same period last year, and you see a substantial drop. This sharp decrease in profitability has forced the company to withdraw its financial guidance, a move that rarely inspires investor confidence. Why the sudden downturn?

Digging Deeper: Understanding the Profit Decline

Several factors likely contributed to this profit slump. Supply chain disruptions, which have plagued the automotive industry for the past few years, probably played a role. Increased competition in the electric vehicle market, coupled with rising raw material costs, could also be squeezing margins. It's a complex equation with no single, easy answer.

The $1.87 Billion Axe: Introducing the Cost-Cutting Plan

In response to these financial headwinds, Volvo Cars is implementing a massive cost-cutting program, aiming to slash expenses by a whopping 18 billion Swedish kronor (approximately $1.87 billion). That's a significant amount of money! But where will these cuts come from? Is it a case of trimming the fat or something more drastic?

A "Cost and Cash Action Plan": What Does it Entail?

The plan, dubbed the "cost and cash action plan," involves several key strategies. Expect reductions in investments, meaning Volvo might be scaling back or delaying certain projects. And, perhaps most concerning, the plan also includes redundancies – layoffs – at operations across the globe. This suggests that Volvo sees these cuts as essential to navigate the current economic climate.

Redundancies on the Horizon: The Human Cost of Efficiency

No one likes to hear about job losses. The mention of "redundancies" signals potential hardship for Volvo employees and their families. Companies often frame such moves as necessary for long-term survival, but that doesn't lessen the impact on those affected. What kind of jobs will be impacted and where?

Global Impact: Where Will the Axe Fall?

The announcement mentions that the cost-cutting measures will impact operations across the globe. This implies that no region is immune. Will the Swedish headquarters be affected, or will the brunt of the cuts be felt in other manufacturing locations or research and development facilities? The details are crucial.

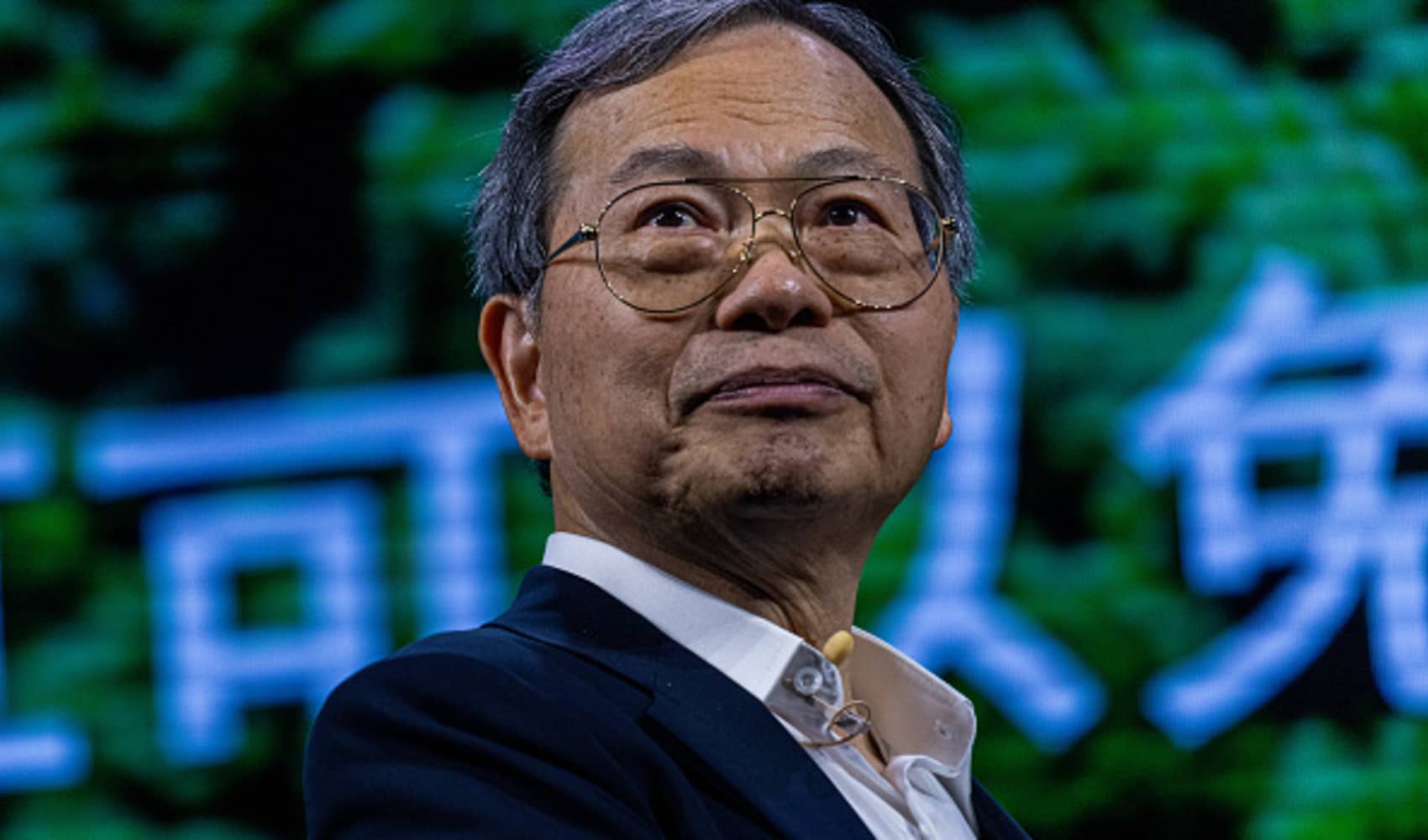

Geely's Influence: Navigating Ownership in a Changing Market

Volvo Cars is owned by China's Geely Holding, a major player in the automotive industry. Geely's support has been instrumental in Volvo's recent growth and electrification strategy. But how does this ownership structure influence Volvo's decision-making during times of crisis? Does Geely have a say in the cost-cutting plan, or is Volvo steering its own course?

The Geely Connection: A Strategic Partnership or a Guiding Hand?

The relationship between Volvo and Geely is complex. While Geely provides financial backing and access to the vast Chinese market, Volvo maintains its distinct brand identity and Swedish engineering heritage. It's a balancing act – a partnership that needs to adapt to the challenges of a rapidly evolving automotive landscape.

The Electric Vehicle Race: Maintaining Momentum Amidst the Downturn

Volvo has committed heavily to electrification, aiming to become a fully electric car company by 2030. But these ambitious plans require significant investment. Will the cost-cutting measures hinder Volvo's progress in the EV race? Or can the company streamline its operations without sacrificing its electric ambitions?

Strategic Priorities: Protecting the EV Investment

It's likely that Volvo will prioritize investments in electric vehicle technology, even as it cuts costs elsewhere. The future of the company hinges on its ability to compete in the rapidly growing EV market. So, we can expect cuts in other areas of the business to ensure Volvo remains on track with their electrification strategy.

Navigating Supply Chain Challenges: A Persistent Headwind

The automotive industry has been grappling with supply chain disruptions for years, and these challenges show no sign of abating completely. From semiconductor shortages to logistical bottlenecks, these disruptions can significantly impact production and profitability. How is Volvo navigating these ongoing challenges?

Building Resilience: Securing the Supply Chain

Companies are exploring various strategies to mitigate supply chain risks, including diversifying suppliers, building larger inventories, and investing in advanced logistics technologies. Is Volvo implementing similar measures to ensure a stable supply of critical components?

The Future of Volvo: A Fork in the Road?

The current situation presents Volvo with a critical juncture. The company must navigate the challenges of declining profitability and rising costs while simultaneously investing in its electric future. Will Volvo emerge stronger and more competitive from this period of austerity? Or will these challenges derail its long-term ambitions?

Reassessing and Rebuilding: A Path to Recovery

This period of cost-cutting and strategic reassessment could ultimately benefit Volvo in the long run. By streamlining its operations, focusing on key priorities, and adapting to the changing market dynamics, Volvo can position itself for renewed growth and success. It's a chance to emerge leaner, more efficient, and more focused on its core strengths.

Market Reaction: Investor Confidence and Share Price Volatility

The market's reaction to Volvo's announcement has been negative, as evidenced by the plunge in share price. Investors are clearly concerned about the company's profitability and future prospects. Will this negative sentiment persist, or can Volvo regain investor confidence by demonstrating a clear path to recovery?

Restoring Trust: Communicating a Clear Vision

Transparent communication is key to restoring investor confidence. Volvo needs to clearly articulate its strategy for navigating the current challenges, demonstrating how the cost-cutting measures will ultimately benefit the company and its shareholders. They need to show investors that this is a temporary setback, not a sign of deeper problems.

Conclusion: Facing the Storm and Charting a New Course

Volvo Cars is facing a challenging period, marked by declining profits, cost-cutting measures, and a withdrawal of financial guidance. The company's response to these challenges will determine its future success in the fiercely competitive automotive market. The key takeaways are the significant profit drop, the aggressive cost-cutting plan, and the potential impact on Volvo's electrification strategy. Volvo's ability to navigate these headwinds and maintain its strategic focus will be crucial for its long-term growth and competitiveness.

Frequently Asked Questions (FAQs)

1. Why are Volvo Cars' shares plunging?

Volvo Cars' shares are declining due to a significant drop in operating profit in the first quarter of the year, coupled with the announcement of a major cost-cutting initiative and the withdrawal of financial guidance. These factors have raised concerns among investors about the company's financial performance and future prospects.

2. What does Volvo's cost-cutting plan entail?

The cost-cutting plan, aiming to save 18 billion Swedish kronor, includes reductions in investments and potential job losses (redundancies) at Volvo Cars' operations worldwide. Specific details about where the cuts will occur are still emerging.

3. Will Volvo's electric vehicle plans be affected by the cost cuts?

While cost cuts are being implemented across the board, Volvo is likely to prioritize investments in electric vehicle technology to maintain its commitment to becoming a fully electric car company by 2030. However, the scale and pace of some projects could be impacted.

4. How does Geely's ownership influence Volvo's decisions?

Geely Holding, Volvo's parent company, provides financial support and access to the Chinese market. While Volvo maintains its brand identity, Geely's influence likely plays a role in strategic decisions, particularly during times of economic challenge.

5. What can Volvo do to regain investor confidence?

To regain investor confidence, Volvo needs to communicate a clear and transparent strategy for addressing the current challenges. This includes outlining how the cost-cutting measures will improve profitability and ensuring that the company remains on track with its electrification goals. Showing concrete results will be key.