Coca-Cola Stock: $1000 in 1988 to Fortune Today?

Coca-Cola Riches: Turning $1,000 into a Fortune with Warren Buffett

The Enduring Allure of Coca-Cola Stock

Coca-Cola. The name conjures up images of refreshing fizz, iconic branding, and for savvy investors, a portfolio powerhouse. In a world where market volatility is the norm, and economic uncertainty looms large, Coca-Cola stock shines as a beacon of stability. Like a trusty old friend, it tends to outperform during market downturns, offering a sense of calm amidst the storm.

But what makes Coca-Cola so resilient? Why is it a staple in Warren Buffett's Berkshire Hathaway portfolio? And, perhaps most importantly, how much would a $1,000 investment made back in 1988, when Buffett first acquired the stock, be worth today? Let's dive in and explore the fascinating story of Coca-Cola's enduring success and its potential for long-term wealth creation.

Coca-Cola: A Consumer Staples Fortress

Coca-Cola's strength lies in its classification as a consumer staples company. Think about it: even when times are tough, people still buy essential goods and services. And while a can of Coke might not be strictly *essential* in the life-or-death sense, it's a widely enjoyed treat and a relatively inexpensive luxury. This makes the demand for Coca-Cola products remarkably stable, regardless of the broader economic climate. It's like needing air, no matter what's going on around you.

Why Consumer Staples Thrive in Uncertainty

During recessions or periods of economic slowdown, consumers tend to cut back on discretionary spending – those fancy dinners out, the expensive new gadgets, the exotic vacations. But they're less likely to forgo their everyday essentials. This means that companies selling products like food, beverages, household goods, and personal care items are generally more insulated from economic shocks. This inherent stability makes consumer staples stocks attractive to investors seeking safety and consistent returns.

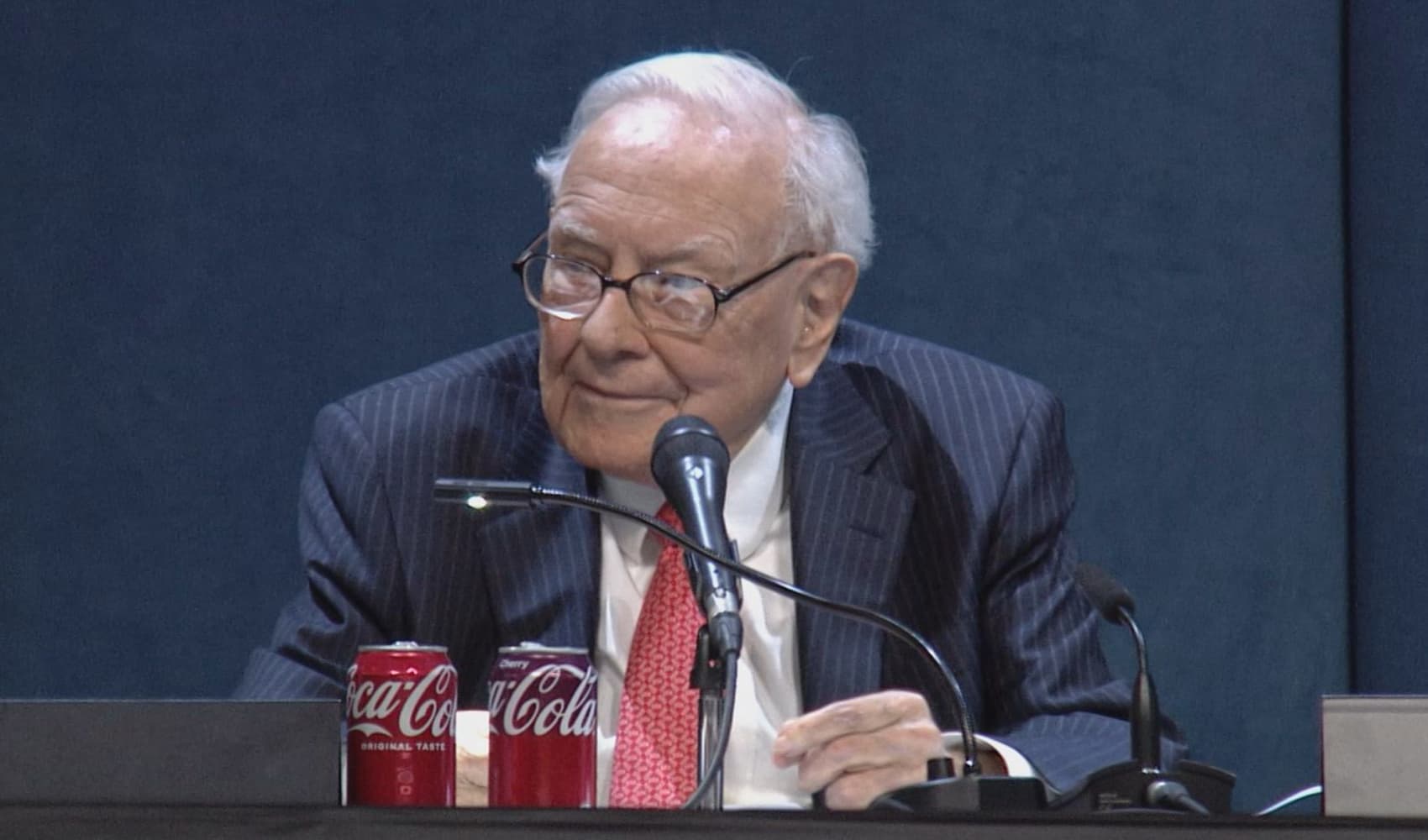

Warren Buffett's Enduring Love Affair with Coca-Cola

Warren Buffett's investment philosophy is all about finding high-quality companies with strong brands, durable competitive advantages, and excellent management teams. And Coca-Cola ticks all those boxes. Berkshire Hathaway first invested in Coca-Cola in 1988, and it has remained one of its largest holdings ever since. It's a testament to the company's enduring appeal and Buffett's renowned patience as a long-term investor.

A Match Made in Investment Heaven

Buffett's investment in Coca-Cola is more than just a financial transaction; it's a symbol of his belief in the power of brands and the importance of long-term thinking. He recognizes that Coca-Cola is more than just a beverage company; it's a cultural icon with a loyal customer base around the globe. This enduring brand equity provides Coca-Cola with a significant competitive advantage, allowing it to maintain pricing power and generate consistent profits. It's like owning a piece of history and getting paid for it.

The Magic of Dividends: A Steady Stream of Income

Another key factor in Coca-Cola's appeal to long-term investors is its long history of consistent dividend payments. The company has a remarkable track record of not only paying dividends but also increasing them year after year, making it a Dividend Aristocrat. This consistent stream of income provides investors with a reliable return on their investment, even during periods of market volatility.

Reinvesting Dividends: The Power of Compounding

The real magic of dividends lies in the power of compounding. By reinvesting your dividend payments back into the stock, you can accelerate your returns over time. This is because you're not only earning dividends on your original investment but also on the shares you've purchased with those dividends. It's like planting a seed and watching it grow into a mighty tree, bearing fruit year after year.

Decoding Coca-Cola's Recent Earnings Report

Let's take a look at Coca-Cola's recent performance. The company reported first-quarter earnings that exceeded analysts' expectations, with revenue coming in at $11.22 billion and earnings per share at 73 cents. These results demonstrate Coca-Cola's ability to navigate challenging economic conditions and continue to grow its business.

Product Innovation and Market Expansion

Coca-Cola isn't resting on its laurels. The company is constantly innovating and expanding its product portfolio to meet changing consumer preferences. Recent product launches of limited-edition soda flavors, as well as its expansion into new beverage categories, have helped to drive revenue growth. It's like a chef constantly experimenting with new recipes to keep customers coming back for more.

Calculating the Return: $1,000 in 1988 to Today

Okay, let's get to the main question: how much would a $1,000 investment in Coca-Cola stock made in 1988 be worth today? This requires a bit of research and some assumptions, but let's break it down.

Factors Affecting the Calculation

Several factors need to be considered when calculating the return, including: the initial share price in 1988, stock splits that have occurred over the years, and dividend reinvestment. Factoring in all these elements paints the complete picture.

The Astonishing Result

Based on historical data and accounting for stock splits and dividend reinvestment, a $1,000 investment in Coca-Cola stock in 1988 would be worth approximately over $70,000 today. This is a testament to the power of long-term investing and the enduring appeal of a high-quality company like Coca-Cola. Remember, past performance is not indicative of future results, but this example highlights the potential for significant wealth creation over time.

Beyond the Numbers: Coca-Cola's Intangible Assets

While the financial metrics are impressive, Coca-Cola's true value extends beyond the numbers. The company possesses intangible assets that are difficult to quantify but crucial to its long-term success.

Brand Recognition and Customer Loyalty

Coca-Cola's brand is one of the most recognizable and valuable in the world. This strong brand recognition fosters customer loyalty, which translates into consistent sales and profits. People around the world have grown up with Coca-Cola, associating it with positive memories and shared experiences. It's more than just a drink; it's a symbol of happiness and connection.

Global Distribution Network

Coca-Cola has a vast and efficient global distribution network, allowing it to reach consumers in virtually every corner of the world. This extensive network provides the company with a significant competitive advantage, making it difficult for competitors to replicate its reach. It's like having a well-oiled machine that delivers your product to millions of customers every day.

Risks and Considerations

No investment is without risk, and Coca-Cola is no exception. While the company has a strong track record, there are several factors that could potentially impact its future performance.

Changing Consumer Preferences

Consumer tastes and preferences are constantly evolving, and Coca-Cola needs to adapt to these changes to remain relevant. The growing popularity of healthier beverage options, such as sparkling water and low-sugar drinks, could pose a challenge to Coca-Cola's traditional soda business.

Competition

The beverage industry is highly competitive, with numerous players vying for market share. Coca-Cola faces competition from both established brands and emerging players, and it needs to constantly innovate and differentiate itself to maintain its leading position.

Economic Slowdowns

While Coca-Cola is relatively resilient during economic downturns, it's not completely immune to their effects. A prolonged recession or a significant decline in consumer spending could negatively impact the company's sales and profits.

The Future of Coca-Cola

Despite the risks, Coca-Cola remains a compelling investment opportunity for long-term investors. The company's strong brand, consistent dividend payments, and global distribution network provide it with a solid foundation for future growth.

Innovation and Expansion

Coca-Cola is committed to innovation and expansion, constantly seeking new ways to reach consumers and grow its business. The company is investing in new products, exploring new markets, and leveraging technology to enhance its operations. It's like a seasoned explorer charting new territories and discovering new opportunities.

Is Coca-Cola Right for Your Portfolio?

Ultimately, the decision of whether or not to invest in Coca-Cola depends on your individual investment goals, risk tolerance, and time horizon. However, if you're seeking a stable, dividend-paying stock with a proven track record of long-term growth, Coca-Cola may be a worthwhile addition to your portfolio. It's a classic investment for a reason.

Conclusion: The Enduring Legacy of a Timeless Brand

Coca-Cola's story is one of enduring success, driven by a strong brand, consistent dividend payments, and a global distribution network. Warren Buffett's long-term investment in Coca-Cola underscores its appeal to patient investors. While past performance is not indicative of future results, the example of a $1,000 investment in 1988 growing to over $70,000 today illustrates the potential for significant wealth creation over time. While risks exist, Coca-Cola's commitment to innovation and expansion positions it for continued success in the years to come. Coca-Cola remains a compelling case study in the power of long-term investing and the enduring value of a timeless brand.

Frequently Asked Questions

Here are some frequently asked questions about investing in Coca-Cola stock:

- Is Coca-Cola stock a good investment for beginners?

Coca-Cola's stability and consistent dividends can make it a good starting point, but it's crucial to diversify your portfolio and understand the risks involved before investing in any stock. Always consult a financial advisor for personalized guidance.

- What are the biggest risks to Coca-Cola's future growth?

Key risks include changing consumer preferences towards healthier beverages, increased competition in the beverage industry, and potential economic downturns that could impact consumer spending.

- How does Coca-Cola compare to other dividend-paying stocks?

Coca-Cola has a long and consistent history of increasing its dividend, making it a popular choice among dividend investors. However, it's important to compare its dividend yield and growth rate to those of other companies in the consumer staples sector.

- What is Warren Buffett's current stake in Coca-Cola?

Berkshire Hathaway currently owns approximately 9.3% of Coca-Cola, making it one of their largest and most enduring holdings.

- Can I buy fractional shares of Coca-Cola stock?

Yes, many brokerage firms now allow you to purchase fractional shares of stock, making it easier to invest in high-priced stocks like Coca-Cola with a smaller initial investment.